Is Wildcard’s $5K GameFi tournament sustainable? We break down its tokenomics, assessing inflation risks and long-term viability.

—#GameFi #Tokenomics #Wildcard

—

Quick Video Breakdown: This Blog Article

This video clearly explains this blog article.

Even if you don’t have time to read the text, you can quickly grasp the key points through this video. Please check it out!

If you find this video helpful, please follow the YouTube channel “GameFi+Plus,” which delivers daily news.

https://www.youtube.com/@GameFiPulse

Read this article in your native language (10+ supported) 👉

[Read in your language]

Wildcard’s $5,000 Preseason Open Tournament: A Tokenomics Lens on Competitive GameFi Sustainability

🎮 Gameplay Type: Competitive Arena Battler

👍 Recommended For: Competitive esports enthusiasts, Tokenomics researchers, Long-term GameFi investors

Lila (Gamer): Hey everyone, if you’re into high-stakes tournaments with a Web3 twist, Wildcard’s Preseason Open sounds thrilling. But let’s not get carried away—John’s here to break down if the economy behind it can actually last.

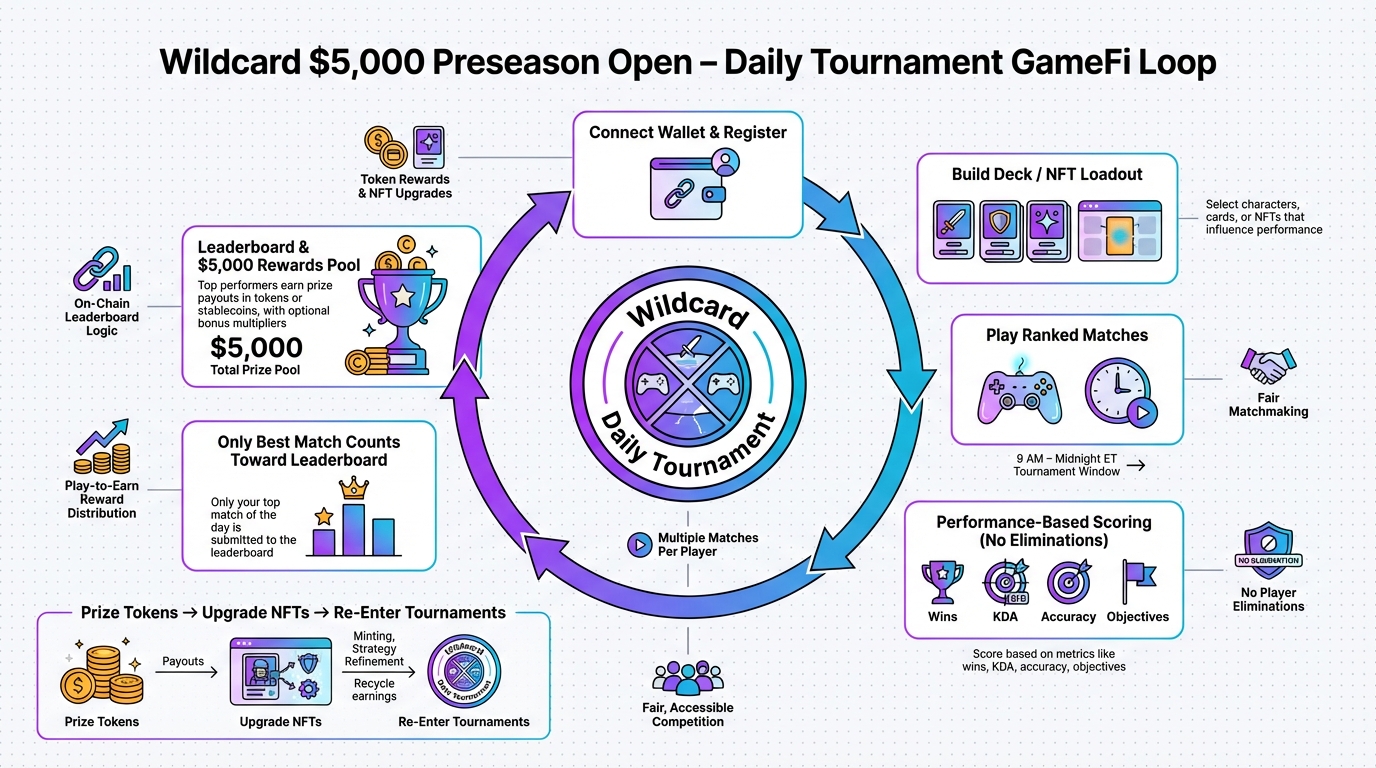

John (Analyst): In the evolving GameFi landscape of 2025, projects like Wildcard are positioning themselves at the intersection of esports and blockchain economies. Drawing from the recently released Wildpaper 4.0, this tournament isn’t just a one-off event; it’s a litmus test for the project’s tokenomics design and long-term viability. With milestones outlined for 2025 and 2026, including ecosystem expansions, we need to examine how such events fit into the broader economic framework—focusing on emission schedules, utility sinks, and potential inflation risks—without falling for the hype.

Before diving into Wildcard’s specifics, consider the “before” state of gaming. In traditional Web2 games, like popular MOBAs or battle arenas, players invest time and money into progression—grinding for levels, buying skins, or competing in ladders—but it’s all siloed. Your assets are essentially rented from the developer; if servers shut down or the game fades, that value evaporates as sunk cost. No real ownership, no secondary markets. Enter GameFi: Wildcard leverages blockchain for true digital ownership via NFTs, allowing players to trade tournament-earned assets on open markets. This shifts the paradigm from pure entertainment to a potential economic loop, but it introduces risks like token volatility that Web2 avoids.

Core Mechanism: Token Economy Breakdown

John (Analyst): Let’s dissect Wildcard’s tokenomics objectively, based on insights from the Wildpaper 4.0 and related ecosystem updates. At its core, Wildcard appears to employ a single-token model—common in GameFi, as noted in general analyses like those on BitcoinEthereumNews—where one utility token drives in-game actions, rewards, and governance. Think of it like gold in a traditional MMO: you earn it through play (tournaments, matches), spend it on upgrades (NFT enhancements or entry fees), and it circulates via trades.

Emission mechanics are key here. From available details, tokens are likely minted through competitive play, such as this $5,000 Preseason Open, where rewards are distributed based on performance. But unchecked emission can lead to inflation, diluting value over time—much like printing endless in-game currency without sinks. Sustainability hinges on token sinks: mechanisms that remove tokens from circulation, such as burning for NFT mints, staking for boosts (locking tokens to earn yields, explained as temporarily parking your assets for passive rewards), or event fees. The Wildpaper hints at competitive systems and ecosystem plans, potentially including these, but we lack on-chain data yet to verify balances.

Long-term risks? High. If player growth stalls post-tournament hype, reward emissions could outpace demand, crashing token value—a classic GameFi pitfall seen in projects relying on hype over utility. Wildcard’s integration of esports and interactive streaming (as per EGamers.io) could mitigate this by driving real engagement, but watch for unlock schedules—phased token releases that might flood the market. Always cross-check with official docs or explorers like Etherscan for transparency.

Lila (Gamer): From a play perspective, it’s like entering a battle arena where your wins could earn real assets, but John’s right—don’t ignore the economic underbelly.

Use Cases / Play Styles

Lila (Gamer): Wildcard offers flexible participation, but outcomes vary based on skill, time, and market conditions. Here are three realistic styles:

1. **Casual Competitor:** Jump into the single-day tournament (9 AM to midnight ET) for fun matches, earning minor token rewards or NFTs without heavy investment. It’s like weekend gaming sessions—low commitment, potential small gains if you perform well, but no guarantees.

2. **Strategic Builder:** Focus on ecosystem features like NFT crafting or upgrades, using tournament earnings to build a portfolio. This suits players who enjoy progression, trading assets on secondary markets to optimize their setup over months.

3. **Guild Participant:** Join or form guilds for collaborative play, pooling resources for bigger tournament entries. This mirrors clan systems in Web2 games but with shared token rewards—great for social gamers, though coordination and market shifts can affect results.

Remember, GameFi is high-risk; start small and verify everything.

Comparison: Traditional Web2 Game vs. Wildcard GameFi

| Feature | Traditional Web2 Game | Wildcard GameFi |

|---|---|---|

| Ownership | Developer-controlled; items can be revoked or lost on shutdown | Blockchain-based NFTs; true player ownership and tradability |

| Progression | Grind-based, no real-world value transfer | Earn-to-progress with token rewards, potentially sellable |

| Economy Design | Closed loop; in-app purchases only | Open economy with token sinks and emissions; risks of inflation |

John (Analyst): This table highlights structural differences—Wildcard’s model empowers players but demands careful economic balancing.

Conclusion

John (Analyst): Wildcard’s Preseason Open Tournament showcases promising design strengths, like integrating competitive play with token utility, potentially fostering a sustainable ecosystem as per the 2025 Blockchain Game Alliance report’s emphasis on growth drivers. However, learning value lies in understanding tokenomics pitfalls: weak sinks could lead to inflation, and external market conditions might amplify risks. Outcomes depend entirely on player behavior, adoption rates, and execution—evaluate data from sources like the Wildpaper before engaging.

Lila (Gamer): It’s got the fun of esports with Web3 perks, but play smart—GameFi isn’t a sure thing.

👨💻 Author: SnowJon (Web3 & AI Practitioner / Researcher)

A researcher leveraging insights from the University of Tokyo Blockchain Innovation Program to analyze GameFi, Web3, and digital economies from a practical and structural perspective.

His focus is on translating complex systems into frameworks that readers can evaluate and think about critically.

*AI may assist with drafting, but final verification and responsibility rest with the human author.

References & Further Reading

- Wildcard Unveils $5,000 Preseason Open Tournament – EGamers.io

- Wildcard Releases Final Wildpaper 4.0 | GAM3S.GG

- Key Takeaways: Blockchain Game Alliance 2025 State of the Industry Report | BitPinas

- GameFi Tokenomics 101: Single-token blockchain games