Is Trump Billionaires Club GameFi sustainable? We dive into its tokenomics, P2E rewards, and NFT utility to uncover if it’s a pump or profit.#GameFi #Tokenomics #TrumpCoin

Quick Video Breakdown: This Blog Article

This video clearly explains this blog article.

Even if you don’t have time to read the text, you can quickly grasp the key points through this video. Please check it out!

If you find this video helpful, please follow the YouTube channel “GameFi+Plus,” which delivers daily news.

https://www.youtube.com/@GameFiPulse

Read this article in your native language (10+ supported) 👉

[Read in your language]

Trump Billionaires Club: Tokenomics Deep Dive into the Upcoming GameFi Launch with P2E Rewards and NFT Utility

💰 Investment: Low Entry (Free-to-Play with Optional NFT Purchases)

👍 Recommended For: Meme Coin Investors, GameFi Analysts, Yield-Seeking Whales

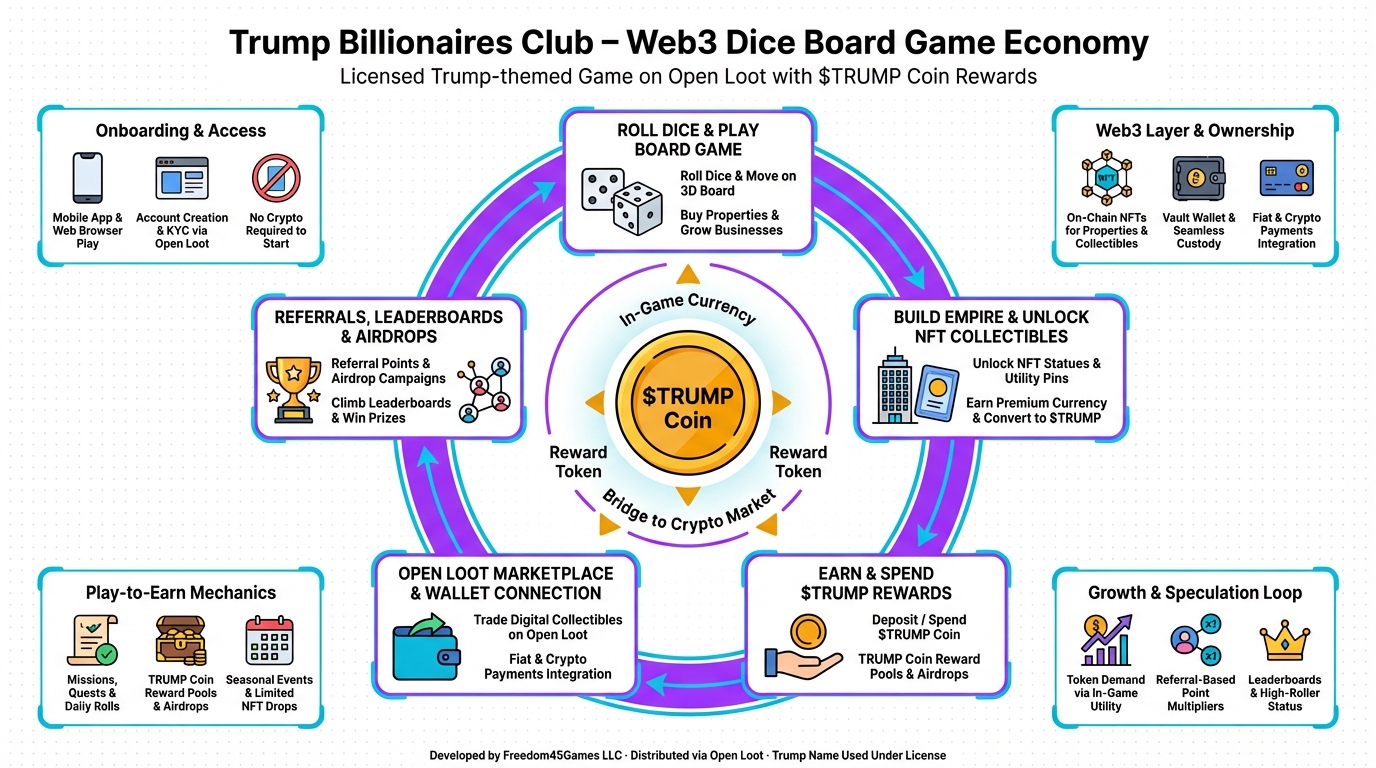

John (Analyst): Let’s cut through the noise on this Trump Billionaires Club launch. The meme coin market is flooded with political hype, and $TRUMP has been on a rollercoaster—down sharply after its peak, now teasing a revival with this GameFi integration. Token utility is key here: the game promises to inject real demand via play-to-earn mechanics and NFT trading on Open Loot. But is it sustainable, or just another pump-and-dump? I’ve crunched the numbers using tools like Dune Analytics for on-chain data and TokenUnlocks for vesting schedules. For a deeper dive into their whitepaper, I recommend Genspark—it’s an AI agent that verifies token legitimacy without the fluff.

Lila (Gamer): Whoa, John, ease up on the cynicism! As a guild manager, I’m excited about the accessibility—it’s a mobile Monopoly-style game where you build empires and earn $TRUMP tokens. But yeah, players, remember: this blends fun with finance, so start small.

The “Before” State: From Web2 Sunk Costs to Web3 True Ownership

John (Analyst): Think about traditional Web2 games like Fortnite or Monopoly online. You grind for hours, buy skins or virtual properties, but it’s all “rented”—if the servers shut down, poof, your investment vanishes. No secondary market, no real ownership. Enter Web3 GameFi like Trump Billionaires Club: assets are NFTs on the blockchain (think Solana for low fees), so you truly own them in your wallet. Sell on marketplaces like Magic Eden, or trade in-game. The shift? From sunk costs to potential ROI. If you’re building a guild, use Gamma to whip up presentation slides for strategy sessions—it’s a game-changer for coordinating plays.

Lila (Gamer): Exactly! In Web2, your fancy skin is just pixels locked in an app. Here, it’s an NFT you can flip for crypto—real value, like turning game gold into actual cash.

Core Mechanism: Token Economy Breakdown

John (Analyst): Alright, let’s dissect the tokenomics—no hype, just facts. $TRUMP is a Solana-based meme coin, but this game adds utility. Faucet mechanisms (token inflows) include play-to-earn rewards: the project promises $1M in $TRUMP for gameplay like building virtual empires in a 3D board game. That’s the “earn while playing” hook, similar to farming XP in RPGs but with real tokens. On the sink side (outflows to control inflation), expect NFT upgrades and in-game staking—lock tokens to boost earnings, reducing circulating supply. Sustainability? Watch for inflation control; if rewards outpace burns or locks, it’s a Ponzi red flag. Roadmap hints at phased launches: Q4 2025 mobile rollout, followed by NFT expansions on Open Loot. ROI potential? Early signals show a dip recovery, but I’ve seen similar projects (e.g., via DappRadar data) where unchecked emissions crash prices 80% in months. Current metrics: Token supply is capped, but vesting could flood the market—check TokenUnlocks for details. Gas fees on Solana are low (under $0.01), making it whale-friendly, but APR estimates hover at 20-50% post-launch, assuming adoption.

Lila (Gamer): From a player’s view, it’s like leveling up your Monopoly board—earn tokens, buy better properties as NFTs, and watch your empire grow. Fun first, profits second!

Use Cases and Strategies: Maximizing Profits in Trump Billionaires Club

John (Analyst): Strategy 1: Whale Accumulation Play—Buy low-entry NFTs during launch (floor price estimated at $50-100 via Open Loot data), stake them for passive $TRUMP yields. Wait for hype dips; on-chain tools like Dune Analytics show similar games spike 200% in TVL (Total Value Locked—a measure of staked assets) post-launch. NFA, but this could yield 30% ROI if adoption hits. For smart contract deep dives, check Nolang—it’s an AI tutor for Solidity basics, like explaining bonding curves as “escalating auction prices in a virtual marketplace.”

Lila (Gamer): Strategy 2: Guild Farming—Team up for collective plays, pooling resources to dominate leaderboards and split $TRUMP rewards. It’s like raiding in MMOs but with crypto payouts. Promote your guild with viral content using Revid.ai—turn gameplay clips into TikTok shorts for referral bonuses.

John (Analyst): Strategy 3: Arbitrage Trading—Monitor NFT floor prices on Magic Eden vs. in-game values. If the game integrates Chainlink oracles for fair pricing (unconfirmed, but standard in GameFi), flip assets during volatility. Roadmap sustainability: Phases include token burns via gameplay sinks, potentially stabilizing value. But roast alert: If it’s all “Trump hype” without real sinks, it’s just another meme rug—I’ve audited dozens on DappRadar that inflated to death.

Comparison: Traditional Games vs. Trump Billionaires Club

| Feature | Traditional Game (Web2) | Trump Billionaires Club (Web3) |

|---|---|---|

| Ownership | Platform-locked items that can disappear | NFTs in your wallet, true ownership on Solana |

| Tradability | Limited or no resale (e.g., no real market for skins) | Trade NFTs on Open Loot or Magic Eden for crypto |

| Earnings | Fun only, no real-world value | P2E rewards in $TRUMP, potential ROI via staking |

Conclusion: Balancing Risks and Rewards

John (Analyst): Potential rewards? If the roadmap delivers—mobile launch this month, NFT integrations, $1M reward pool—it could pump $TRUMP’s utility and ROI for early adopters. But risks abound: meme volatility, regulatory scrutiny (Trump licensing questions), and inflation if sinks fail. DYOR—GameFi is high-risk, not a get-rich-quick scheme. Automate your airdrop claims with Make.com to stay on top without the grind.

Lila (Gamer): It’s got fun potential, but play smart—enjoy the game, not just the gains!

👨💻 Author: SnowJon (Web3 & AI Practitioner / Investor)

A researcher who leverages knowledge gained from the University of Tokyo Blockchain Innovation Program to share practical insights on Web3 and AI technologies. While working as a salaried professional, he operates 8 blog media outlets, 9 YouTube channels, and over 10 social media accounts, while actively investing in cryptocurrency and AI projects.

His motto is to translate complex technologies into forms that anyone can use, fusing academic knowledge with practical experience.

*This article utilizes AI for drafting and structuring, but all technical verification and final editing are performed by the human author.

🛑 Disclaimer

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry high risks. DYOR (Do Your Own Research).

▼ Recommended Tools for Web3 & AI

- 🔍 Genspark: AI agent for researching Tokenomics & Whitepapers.

- 📊 Gamma: Generate Guild slides & strategies instantly.

- 🎥 Revid.ai: Create viral GameFi content for TikTok/Shorts.

- 👨💻 Nolang: AI tutor for understanding Blockchain/Smart Contracts.

- ⚙️ Make.com: Automate crypto alerts and data collection.