Personally, P2E games now prioritize functional economies over temporary excitement.#GameFi #Tokenomics

Quick Video Breakdown: This Blog Article

This video clearly explains this blog article.

Even if you don’t have time to read the text, you can quickly grasp the key points through this video. Please check it out!

If you find this video helpful, please follow the YouTube channel “GameFi+Plus,” which delivers daily news.

https://www.youtube.com/@GameFiPulse

Read this article in your native language (10+ supported) 👉

[Read in your language]

COMING IN HOT! Top 5 Play to Earn Games To Watch in January 2026: A Deep Dive into Tokenomics and Sustainability

🎮 Gameplay Type: Varied (Strategy, RPG, Card, Action)

👍 Recommended For: Tokenomics Analysts, Market Researchers, Long-Term Investors in GameFi

As we step into January 2026, the GameFi sector continues to evolve amid a maturing blockchain gaming market. With over 5.8 million daily users in Q1 2025 as reported by sources like XT Exchange, projects are shifting from hype-driven launches to more structured economies. This article dissects the top 5 Play-to-Earn (P2E) games worth monitoring—drawing from recent analyses on sites like CoinGabbar and HyroTrader—focusing on their tokenomics, sustainability models, and potential long-term risks. These include The Beacon, Wildcard, Forgotten Runiverse, Legend of YMIR, and Parallel TCG. We’ll examine why these projects stand out structurally in a landscape plagued by inflation and rug pulls, emphasizing evidence-based design over speculative promises.

John (Analyst): Look, I’ve seen enough “revolutionary” GameFi projects crash and burn because their economies were built on sand. These top 5 for 2026? They’re attempting real sustainability, but let’s audit the numbers—no hype, just on-chain reality.

Lila (Gamer): Totally agree, John. As someone who’s grinded through beta tests, the fun matters, but if the economy tanks, so does the player base. Excited to bridge the gameplay side here!

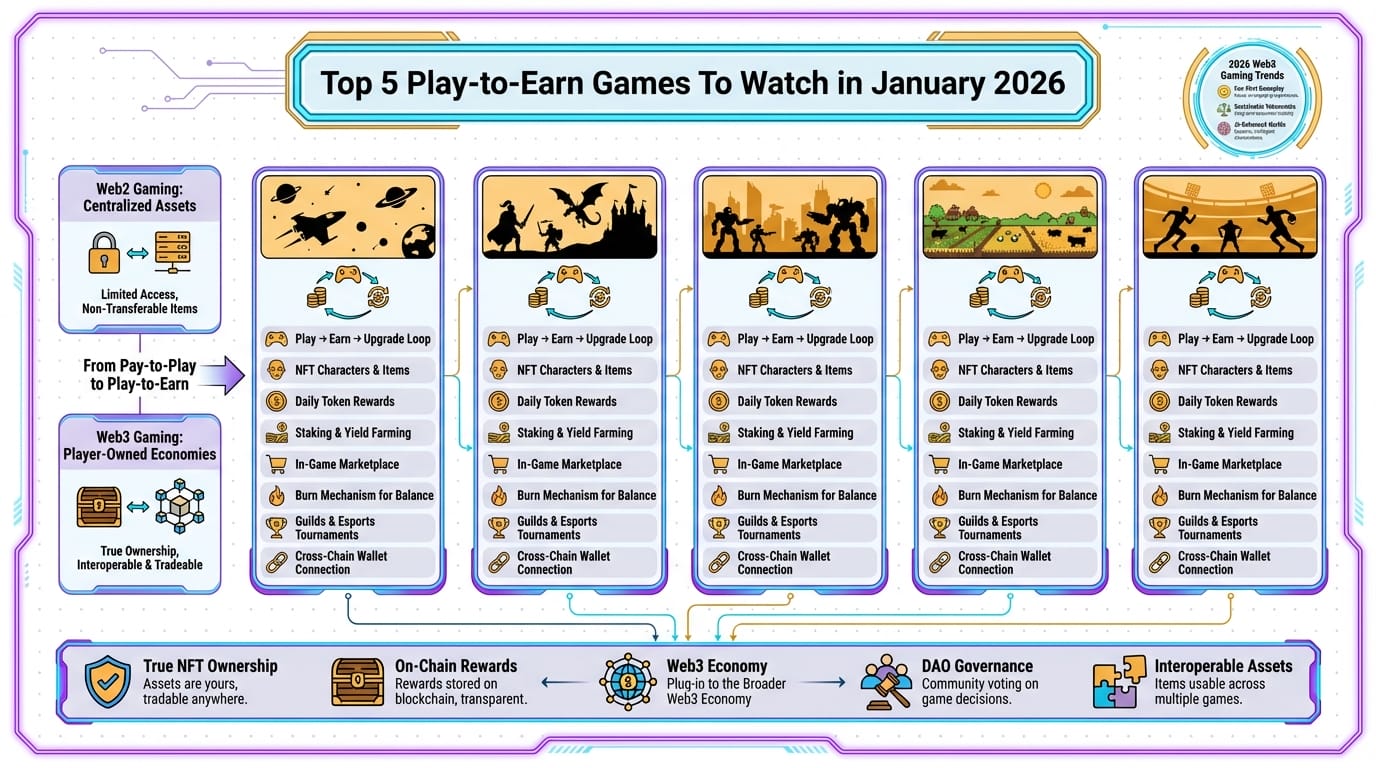

The “Before” State: Web2 Games vs. GameFi Evolution

In traditional Web2 games like Fortnite or League of Legends, players invest time and money into cosmetics, levels, and items that remain locked within the publisher’s ecosystem. There’s no true ownership—servers shut down, and your “assets” vanish, turning hours of play into sunk costs without resale value. GameFi flips this script by integrating blockchain, where NFTs provide verifiable ownership and secondary markets allow trading. However, this introduces complexities like token inflation, where excessive rewards can devalue the entire economy. The top 5 games in 2026 are building on lessons from early failures like Axie Infinity‘s SLP token crash, aiming for balanced systems that reward play without endless printing.

John (Analyst): Exactly. Web2 is like renting a fancy car you can’t sell; GameFi lets you own it, but if the project’s token supply balloons unchecked, it’s like owning a depreciating asset in a hyperinflated economy.

Core Mechanism: Token Economy Breakdown

At the heart of these top 5 P2E games lies a focus on tokenomics that balances emission (new tokens entering circulation) with sinks (mechanisms that remove tokens, like burning or staking). For instance, The Beacon, an RPG built on Arbitrum, uses a dual-token system where governance tokens control DAO decisions—think community voting on updates—and utility tokens fuel in-game actions. Emission is capped via play-based rewards, but sustainability hinges on active sinks like item upgrades that burn tokens, preventing inflation.

Wildcard, a strategy game on Polygon, employs Chainlink VRF for fair randomness in battles, with tokenomics centered on NFT card ownership. Rewards are emitted through tournaments, but a key sink is the liquidity pool—a pot of money enabling instant trades—where fees contribute to token burns. Forgotten Runiverse, an action RPG on Ronin, integrates Immutable X for low-fee NFT trades, with economy design featuring vesting schedules (locked token releases over time) to mitigate dump risks.

Legend of YMIR, leveraging Solana for speed, focuses on token sinks via crafting mechanics where players burn resources to create rarer items. Parallel TCG, a card game on Base, uses bonding curves—mathematical formulas that increase prices as supply tightens—for its token economy, aiming to reward long-term holders. Long-term risks include external market volatility; if player adoption drops, even strong sinks can’t counter low demand, leading to token value erosion.

John (Analyst): Roast time: If a game promises “unlimited earning,” it’s likely a Ponzi hiding behind buzzwords. These projects? Their whitepapers (check audits on sites like Certik) show real math—emission rates below 5% annually for some, with verifiable sinks on explorers like Etherscan.

Lila (Gamer): From a player view, these loops feel like grinding for gold in an MMO, but with the twist of real-world value—upgrade your gear, sell on marketplaces, repeat. Just watch gas fees!

Remember: GameFi is high-risk; outcomes depend on market conditions, not guarantees.

Use Cases / Participation Styles

Engaging with these top 5 games can take various forms, each with its structural considerations. First, as a passive observer: Monitor token metrics on dashboards like Dune Analytics without playing, evaluating sustainability through on-chain data like active wallets and burn rates. This low-commitment style suits researchers tracking trends.

Second, active participation as a mid-tier player: Invest modestly in NFTs (e.g., a starter card in Parallel TCG) and engage in daily quests for rewards. Focus on game economy design—stake tokens for yields, but verify unlock schedules to avoid rug pulls. This balances involvement with risk management.

Third, community-driven involvement: Join DAOs in projects like The Beacon, proposing economy tweaks via governance tokens. This style emphasizes long-term sustainability, as votes can influence sinks and emissions, but requires understanding risks like proposal failures leading to economic imbalances.

John (Analyst): No guaranteed profits here—participate based on data, start small, and always verify contract addresses on official docs.

Comparison: Traditional Web2 Games vs. These GameFi Projects

| Aspect | Traditional Web2 Game | These GameFi Projects (e.g., The Beacon, Wildcard) | Ownership | Publisher-controlled; items can’t be traded outside the game. | NFT-based true ownership; sell on secondary markets like OpenSea. | Progression | Grind for levels/items that reset or depreciate on shutdown. | Earn-and-upgrade loop with token sinks for sustainable growth. | Economy Design | Closed-loop; no real-world value transfer. | Open economy with emission controls and risks like inflation. |

|---|

Conclusion: Weighing Strengths and Risks

In summary, these top 5 P2E games—The Beacon, Wildcard, Forgotten Runiverse, Legend of YMIR, and Parallel TCG—offer valuable lessons in GameFi design, from robust token sinks that combat inflation to NFT ownership models that enhance player agency. Their strengths lie in evidence-based economies, often backed by audits and on-chain transparency, positioning them as potential blue chips in a volatile sector. However, structural risks persist: dependency on player retention, external crypto market swings, and the ever-present threat of unbalanced tokenomics leading to value dilution. Outcomes ultimately depend on individual player behavior, broader adoption, and evolving market conditions—approach with caution, verify data, and remember GameFi’s high-risk nature.

John (Analyst): Bottom line? These aren’t get-rich-quick schemes. Audit the economy, watch the data, and play smart.

Lila (Gamer): And don’t forget the fun—sustainable games keep us coming back!

👨💻 Author: SnowJon (Web3 & AI Practitioner / Researcher)

A researcher leveraging insights from the University of Tokyo Blockchain Innovation Program to analyze GameFi, Web3, and digital economies from a practical and structural perspective.

His focus is on translating complex systems into frameworks that readers can evaluate and think about critically.

*AI may assist with drafting, but final verification and responsibility rest with the human author.

References & Further Reading

- Top Play to Earn Games to Watch in January 2026 – CoinGabbar

- 10 Best Play to Earn Crypto Games 2026 | Complete ROI Guide – HyroTrader

- The 10 Best NFT Games Worth Playing in 2026 – NFT Plazas

- Crypto Gaming & GameFi Trends of 2025/2026: Top Tokens & Projects – Iconomi

- 10 Best Play-to-Earn Games for Earning Crypto Rewards in 2026 – Coinspeaker

▼ AI tools to streamline research and content production (free tiers may be available)

Free AI search & fact-checking

👉 Genspark

Recommended use: Quickly verify key claims and track down primary sources before publishing

Ultra-fast slides & pitch decks (free trial may be available)

👉 Gamma

Recommended use: Turn your article outline into a clean slide deck for sharing and repurposing

Auto-convert trending articles into short-form videos (free trial may be available)

👉 Revid.ai

Recommended use: Generate short-video scripts and visuals from your headline/section structure

Faceless explainer video generation (free creation may be available)

👉 Nolang

Recommended use: Create narrated explainer videos from bullet points or simple diagrams

Full task automation (start from a free plan)

👉 Make.com

Recommended use: Automate your workflow from publishing → social posting → logging → next-task creation

※Links may include affiliate tracking, and free tiers/features can change; please check each official site for the latest details.