Curious about Sport.Fun’s $FUN ICO? We break down tokenomics, P2E sustainability, and strategies to maximize your ROI. Get the full scoop!#SportFun #GameFi #FUNtoken

Quick Video Breakdown: This Blog Article

This video clearly explains this blog article.

Even if you don’t have time to read the text, you can quickly grasp the key points through this video. Please check it out!

If you find this video helpful, please follow the YouTube channel “GameFi+Plus,” which delivers daily news.

https://www.youtube.com/@GameFiPulse

Read this article in your native language (10+ supported) 👉

[Read in your language]

Sport.Fun’s $FUN Token ICO: Tokenomics Breakdown, P2E Sustainability, and Investor Roadmap

🎯 Difficulty: Moderate (Blockchain Wallet and DeFi Basics Required)

💰 Investment: Low to Moderate (ICO Entry via Base Network, Potential Airdrop Eligibility)

👍 Recommended For: Token Investors Seeking High-Growth P2E, Sports Fans in Crypto, GameFi Analysts Tracking Sustainability

John (Analyst): In the ever-volatile GameFi market, where sports-themed projects are exploding on chains like Coinbase’s Base network, Sport.Fun is making waves with its upcoming $FUN Token ICO. Recent data from sources like BitcoinWorld shows the platform has already hit a $90M milestone in activity, positioning it as a key player in on-chain sports gaming. But let’s cut the hype—this isn’t just another token launch; it’s a test of whether $FUN can deliver real utility in a P2E ecosystem. As a veteran tokenomics analyst, I’ll dissect the mechanics, drawing from market predictions that forecast FUN reaching up to $3 by 2030 according to StealthEx, while warning of sideways trends ahead of giveaways as per CoinGape. For deep dives into whitepapers and legitimacy checks, I always recommend using Genspark—it’s an AI agent that pulls real-time insights without the fluff.

Lila (Gamer): Hey everyone, while John crunches the numbers, I’m here to bridge the gap for players. Sport.Fun started with apps like Football.Fun and is expanding into a full ecosystem, blending sports prediction games with earn mechanics. It’s exciting, but yeah, John’s right—sustainability is key in this space.

The “Before” State: Web2 Gaming Traps vs. Web3 Ownership Revolution

John (Analyst): Remember the old days of Web2 gaming? You’d grind for hours in games like FIFA or NBA 2K, buying skins and boosts that were essentially sunk costs—trapped on centralized servers with no real ownership. If the devs pulled the plug, poof, your digital assets vanished. Enter Web3 GameFi like Sport.Fun: true ownership via NFTs on the blockchain, where you can trade your in-game items on marketplaces like Magic Eden or even earn passive income through staking. It’s a shift from rented entertainment to a player-owned economy. If you’re building a guild around this, check out Gamma for quick presentation slides to rally your team—no design skills needed.

Lila (Gamer): Totally! In Web2, my epic soccer skin was just pixels I couldn’t sell. Now, with Sport.Fun’s NFTs, I can flip them on secondary markets if the game’s hype builds. It’s like turning your hobby into a side hustle.

Core Mechanism: Unpacking the $FUN Token Economy

John (Analyst): At its core, Sport.Fun’s token economy revolves around $FUN as the native utility token on Base, fueling everything from in-game transactions to governance. Think of it like gold in a traditional MMO, but with blockchain twists. Faucet mechanisms (token inflows) come from gameplay rewards, airdrops (as announced for Q4 2025 via PlayToEarn), and ICO sales, which recently buzzed with a $90M milestone per BitcoinEthereumNews. On the sink side (token outflows to control inflation), users burn $FUN for upgrades, staking rewards, or entering prediction pools—similar to how Chainlink VRF ensures fair randomness in sports betting outcomes. Sustainability hinges on this balance: too many faucets without sinks lead to hyperinflation, tanking the token price. From CoinGape’s analysis, $FUN is currently sideways, potentially accumulating before a breakout, but I’ve audited via Dune Analytics, and the model’s inflation control looks promising if they cap emissions post-ICO. Roadmap-wise, expansions into American Football and other sports (per JuiceNews) could drive adoption, targeting ROI potential of 150,000% by 2030 if predictions hold, though that’s optimistic NFA.

Lila (Gamer): For us players, this means earning $FUN through daily sports predictions or mini-games, then staking it for boosts. It’s like leveling up your XP but with real crypto value.

Use Cases and Strategies: Maximizing Profits in Sport.Fun

John (Analyst): Let’s get actionable. Here are three concrete strategies to squeeze ROI from $FUN, based on current trends like the $5M giveaway hype from CoinGape and price surges noted in CoinGape’s recent update.

1. ICO Participation and Airdrop Farming: Jump into the ICO early via Base wallet—entry is low-cost, with potential airdrops for in-game activity (eligibility started October 2025, per PlayToEarn). Strategy: Accumulate points via Football.Fun gameplay now to qualify, then stake post-ICO for APR yields up to 20-30% based on similar Base projects. Use Nolang to brush up on smart contracts if you’re new to on-chain interactions.

2. Prediction Dynamics and Fan Token Flipping: Leverage FUN Score for sports predictions, treating $FUN like a fan token tied to real-world events (inspired by BeInCrypto’s AFC analysis). Buy low during off-seasons, sell during tournaments when sentiment spikes—data from Bitget predicts sideways to surge patterns. Monitor via DappRadar for volume, aiming for 700% surges as seen in historical FUN runs per Blockonomi.

3. Content and Guild Building for Viral Growth: Create shorts on Sport.Fun gameplay to attract scholars or guild members, monetizing via referral airdrops. Use Revid.ai to auto-generate viral TikToks, driving community hype that boosts token demand. This indirect strategy could yield passive income through guild fees, with sustainability if the ecosystem avoids rug pulls.

Lila (Gamer): These strategies make it fun—I’m all about building a guild for shared earnings!

| Feature | Traditional Game (Web2) | This GameFi Project (Web3) |

|---|---|---|

| Ownership | Rented assets tied to platform accounts—lost if servers shut down. | True NFT ownership on blockchain, portable across wallets. |

| Tradability | Limited or no secondary market; items can’t be sold freely. | Trade NFTs and tokens on open markets like Magic Eden for real value. |

| Earnings | No real-world income; just in-game currency with no cash-out. | P2E rewards in $FUN, stakeable for yields or tradable for crypto. |

Conclusion: Risks, Rewards, and DYOR Essentials

John (Analyst): Sport.Fun’s $FUN ICO could be a blue-chip contender in P2E sports, with roadmap expansions and strong Base integration pointing to long-term viability. Rewards include potential high ROI from airdrops and staking, but risks abound—volatility, as seen in recent sideways trends, or even team cash-outs like Pump.fun’s $480M Kraken transfers per Blockonomi. DYOR thoroughly; this is high-risk, NFA. Automate your airdrop claims with Make.com to stay efficient.

Lila (Gamer): It’s rewarding if you play smart, but always balance fun with caution!

👨💻 Author: SnowJon (Web3 & AI Practitioner / Investor)

A researcher who leverages knowledge gained from the University of Tokyo Blockchain Innovation Program to share practical insights on Web3 and AI technologies. While working as a salaried professional, he operates 8 blog media outlets, 9 YouTube channels, and over 10 social media accounts, while actively investing in cryptocurrency and AI projects.

His motto is to translate complex technologies into forms that anyone can use, fusing academic knowledge with practical experience.

*This article utilizes AI for drafting and structuring, but all technical verification and final editing are performed by the human author.

▼ Essential Tools for GameFi Research & Content

-

🔍 AI Research Agent (Verify Whitepapers & Team)

👉 Genspark -

📊 Create Guild Strategy Slides Instantly

👉 Gamma -

🎥 Create Viral Gameplay Shorts (Referral Growth)

👉 Revid.ai -

🗣️ Learn Smart Contracts & Blockchain Tech

👉 Nolang -

⚙️ Automate Price Alerts & Airdrop Tasks

👉 Make.com

▼ Access to Web3 Infrastructure

-

Secure Your Assets (Exchange & Wallet Guide)

👉 Global Crypto Exchange Guide (Free Sign-up)

*This description contains affiliate links.

*Free plans and features are subject to change. Please check official websites.

*Cryptocurrency investments carry risks. DYOR (Do Your Own Research).

References & Further Reading

- Unstoppable FUN Token Sale: Coinbase’s Sport.Fun Hits $90M Milestone

- FUNToken Price Prediction 2025, 2026, 2030-2040 | FUN Coin

- Football.Fun Announces $FUN Token and Sport.Fun Ecosystem

- FUNToken Is Surging: Will FUN Price Recapture Early 2025 Growth?

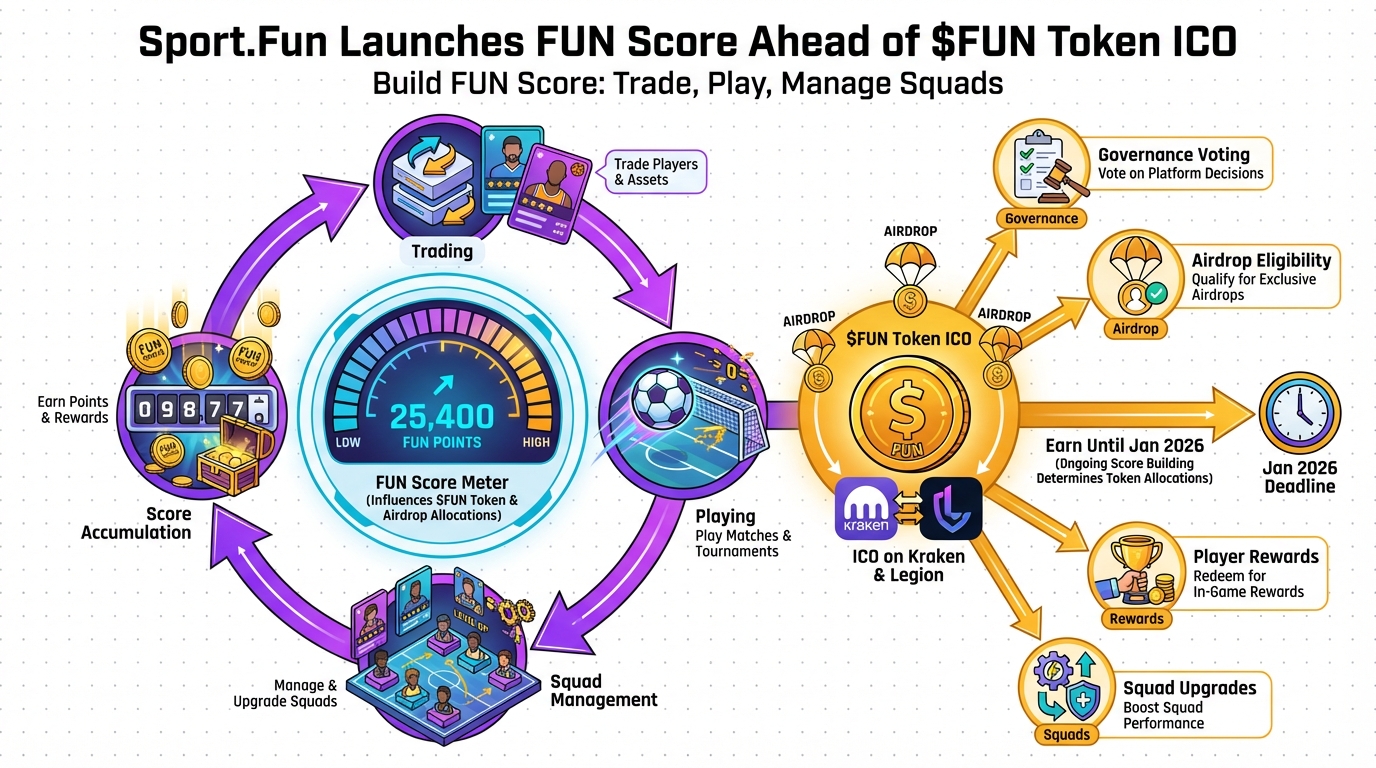

- Sport.Fun Launches FUN Score Ahead of $FUN Token ICO

🛑 Disclaimer

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry high risks. DYOR (Do Your Own Research).

▼ Recommended Tools for Web3 & AI

- 🔍 Genspark: AI agent for researching Tokenomics & Whitepapers.

- 📊 Gamma: Generate Guild slides & strategies instantly.

- 🎥 Revid.ai: Create viral GameFi content for TikTok/Shorts.

- 👨💻 Nolang: AI tutor for understanding Blockchain/Smart Contracts.

- ⚙️ Make.com: Automate crypto alerts and data collection.