Imagine owning your game assets and earning from them. Sony Bank’s USD stablecoin could revolutionize PlayStation & anime by 2026.#SonyBank #GameFi #Stablecoin

Quick Video Breakdown: This Blog Article

This video clearly explains this blog article.

Even if you don’t have time to read the text, you can quickly grasp the key points through this video. Please check it out!

If you find this video helpful, please follow the YouTube channel “GameFi+Plus,” which delivers daily news.

https://www.youtube.com/@GameFiPulse

Read this article in your native language (10+ supported) 👉

[Read in your language]

Sony Bank’s USD Stablecoin: Revolutionizing GameFi with Seamless P2E Payments and NFT Integrations by 2026

🎯 Difficulty: Moderate (Basic Wallet Knowledge Req)

💰 Investment: Low Entry (Stablecoin Usage, Potential for Yield via DeFi Integrations)

👍 Recommended For: Crypto Investors, GameFi Analysts, Anime & Gaming Enthusiasts

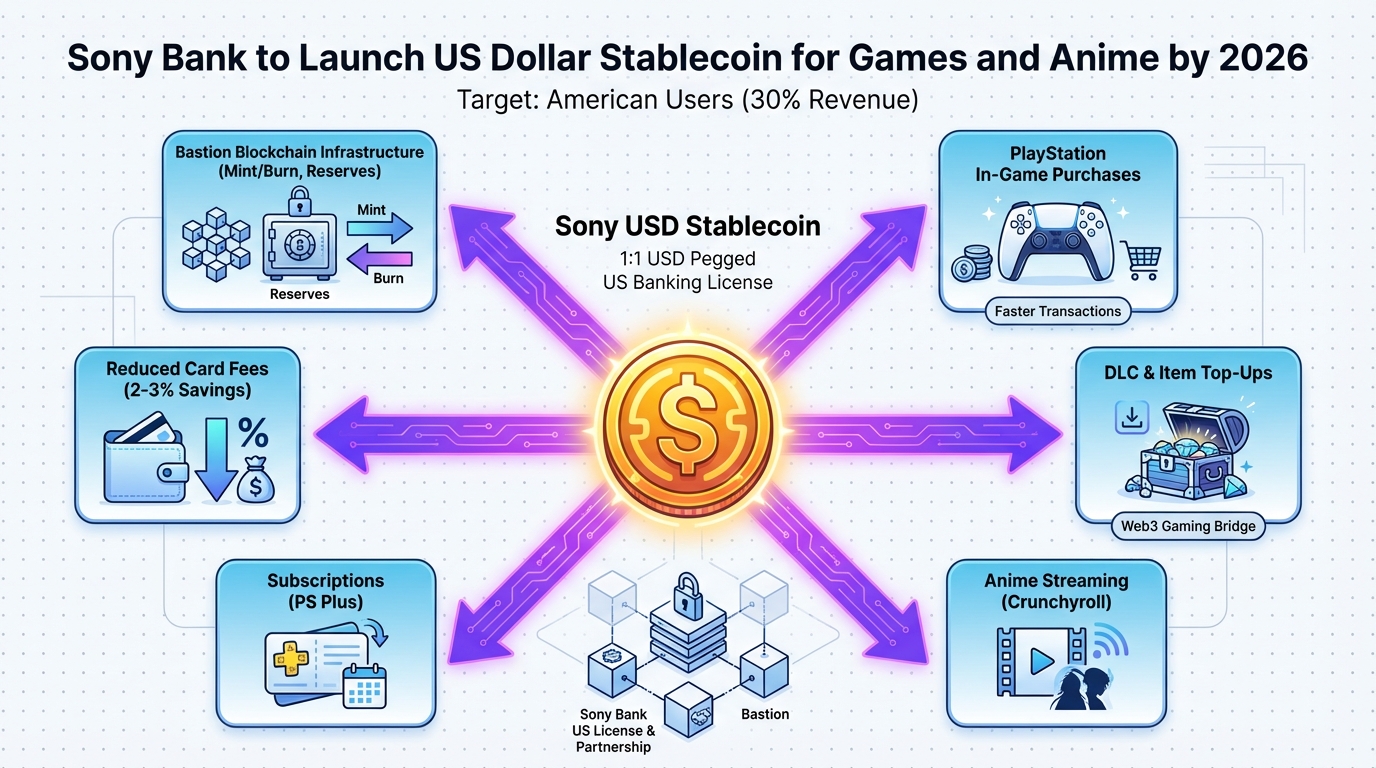

John (Analyst): Let’s cut through the noise on Sony Bank’s upcoming USD-pegged stablecoin. In a market where stablecoins like USDT and USDC dominate with over $150 billion in combined market cap, Sony’s entry—backed by a tech giant—isn’t just another token; it’s a strategic play to tokenize payments in their massive gaming and anime ecosystem. According to recent reports from Nikkei and CoinDesk, this stablecoin aims to streamline transactions for PlayStation games and Crunchyroll anime, potentially reducing fees by up to 30% compared to traditional credit cards. As a veteran analyst, I’ve crunched the numbers: this could onboard millions of Web2 users into Web3 without them even realizing it. For deep dives into the whitepaper (once released), I recommend using Genspark—it’s an AI agent that pulls real-time data on token legitimacy and backing mechanisms. But remember, NFA—this is high-risk territory, with regulatory hurdles looming.

Lila (Gamer): Whoa, John, you’re all about the charts, but imagine logging into your PS5, buying in-game skins or anime episodes with a stablecoin that doesn’t fluctuate like crazy crypto! It’s like upgrading from clunky V-Bucks to something you can actually trade or earn from. Exciting times ahead for us gamers.

The “Before” State: Web2 Gaming’s Sunk Costs vs. Web3’s True Ownership

In traditional Web2 gaming—like Fortnite or League of Legends—you grind for hours, sink money into cosmetics or boosts, but it’s all trapped. Those skins? They’re “yours” until the servers shut down or the company decides otherwise—no resale value, no real ownership. It’s a black hole of time and cash. Enter Web3 gaming, where NFTs (non-fungible tokens, basically unique digital collectibles on the blockchain) give you true ownership. Sell that rare sword on marketplaces like OpenSea, or use it across games. Sony’s stablecoin could bridge this: pay for PlayStation assets that become NFTs, tradable on secondary markets. For guild managers building teams, tools like Gamma are gold—whip up presentation slides for strategies in minutes.

John (Analyst): Exactly, Lila. Web2 is a rental agreement; Web3 is property deeds. But let’s audit: Sony’s move might integrate with networks like Polygon for low gas fees (under $0.01 per tx), making it sustainable.

Core Mechanism: Token Economy of Sony’s USD Stablecoin

John (Analyst): At its core, this stablecoin is pegged 1:1 to the USD, likely backed by reserves through partners like Bastion (a U.S.-based issuer). Tokenomics here emphasize stability over hype—no wild inflation like meme coins. Faucet mechanisms? Think inflows from user deposits converting fiat to stablecoins for in-app purchases. Sinks? Redemptions back to USD or spending on Sony content, controlling supply. Inflation is curbed by algorithmic reserves, potentially using Chainlink oracles for price feeds to maintain the peg. Sustainability looks solid: Sony’s $100B+ market cap provides backing, but watch for audits via tools like Dune Analytics to track on-chain reserves. Roadmap points to a 2026 launch, with phased rollouts—first for U.S. users, then global. ROI? Low volatility means 1-5% yields if integrated with DeFi staking, but it’s more about utility than moonshots.

Lila (Gamer): Sounds fancy, but in gamer terms: it’s like stable gold coins in an RPG—always worth the same, no market crashes mid-quest.

Use Cases / Strategies: Maximizing Profits with Sony’s Stablecoin

John (Analyst): Strategy 1: Arbitrage Opportunities. Buy low-volatility assets in Sony games using the stablecoin, then flip NFTs on Magic Eden if values spike post-launch. With projected floor prices starting at $10-50 for entry-level items, early adopters could see 20-30% ROI via secondary sales—track via DappRadar.

Strategy 2: Yield Farming Integrations. If Sony ties this to DeFi (e.g., via Aave or Compound), stake your stablecoins for 3-7% APR. Combine with guild scholarships: lend stablecoins to new players for a cut of their earnings. For content creators promoting this, use Revid.ai to make viral TikToks on “How Sony’s Coin Changes Gaming.”

Strategy 3: Cross-Ecosystem Plays. Use the stablecoin for anime purchases on Crunchyroll, then convert rewards to game assets. Learn the smart contracts behind it with Nolang, an AI tutor for Solidity basics—essential for spotting rugs.

Lila (Gamer): Love these! As a guild manager, I’d automate airdrop claims with bots to stack rewards hassle-free.

Comparison Table: Traditional Game (Web2) vs. This GameFi Project (Web3)

| Feature | Traditional Game (Web2) | Sony Stablecoin GameFi (Web3) |

|---|---|---|

| Ownership | Platform-locked (e.g., Epic owns your Fortnite skins) | True blockchain ownership via NFTs |

| Tradability | None—can’t sell or trade items outside the game | Secondary markets like OpenSea for real USD value |

| Earnings | No real-world income; just in-game currency | P2E potential via stablecoin rewards and yields |

Conclusion: Risks, Rewards, and the Road Ahead

John (Analyst): Rewards? Massive: Sony could capture a slice of the $200B gaming market with low-fee, borderless payments, boosting ROI for early holders through ecosystem growth. Risks? Peg breaks (rare but possible, like UST’s crash), regulatory crackdowns, or adoption flops. DYOR—use TokenUnlocks to monitor supply. High-risk, high-reward; automate your edge with Make.com for reward claims.

Lila (Gamer): Fun factor is huge, but play smart!

👨💻 Author: SnowJon (Web3 & AI Practitioner / Investor)

A researcher who leverages knowledge gained from the University of Tokyo Blockchain Innovation Program to share practical insights on Web3 and AI technologies. While working as a salaried professional, he operates 8 blog media outlets, 9 YouTube channels, and over 10 social media accounts, while actively investing in cryptocurrency and AI projects.

His motto is to translate complex technologies into forms that anyone can use, fusing academic knowledge with practical experience.

*This article utilizes AI for drafting and structuring, but all technical verification and final editing are performed by the human author.

🛑 Disclaimer

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry high risks. DYOR (Do Your Own Research).

▼ Recommended Tools for Web3 & AI

- 🔍 Genspark: AI agent for researching Tokenomics & Whitepapers.

- 📊 Gamma: Generate Guild slides & strategies instantly.

- 🎥 Revid.ai: Create viral GameFi content for TikTok/Shorts.

- 👨💻 Nolang: AI tutor for understanding Blockchain/Smart Contracts.

- ⚙️ Make.com: Automate crypto alerts and data collection.