Wondering if Shatterpoint Season 2’s airdrop is your next GameFi goldmine? We dissect its P2E model and $POINT TGE for potential ROI.#GameFi #Shatterpoint #Airdrop

Quick Video Breakdown: This Blog Article

This video clearly explains this blog article.

Even if you don’t have time to read the text, you can quickly grasp the key points through this video. Please check it out!

If you find this video helpful, please follow the YouTube channel “GameFi+Plus,” which delivers daily news.

https://www.youtube.com/@GameFiPulse

Read this article in your native language (10+ supported) 👉

[Read in your language]

Shatterpoint Season 2: P2E Airdrop Opportunities and $POINT Token TGE Analysis for 2026

🎯 Difficulty: Moderate (Wallet and Basic Crypto Knowledge Required)

💰 Investment: Low Entry (Free-to-Play with Optional NFT Purchases)

👍 Recommended For: Crypto Investors, GameFi Analysts, Yield Farmers

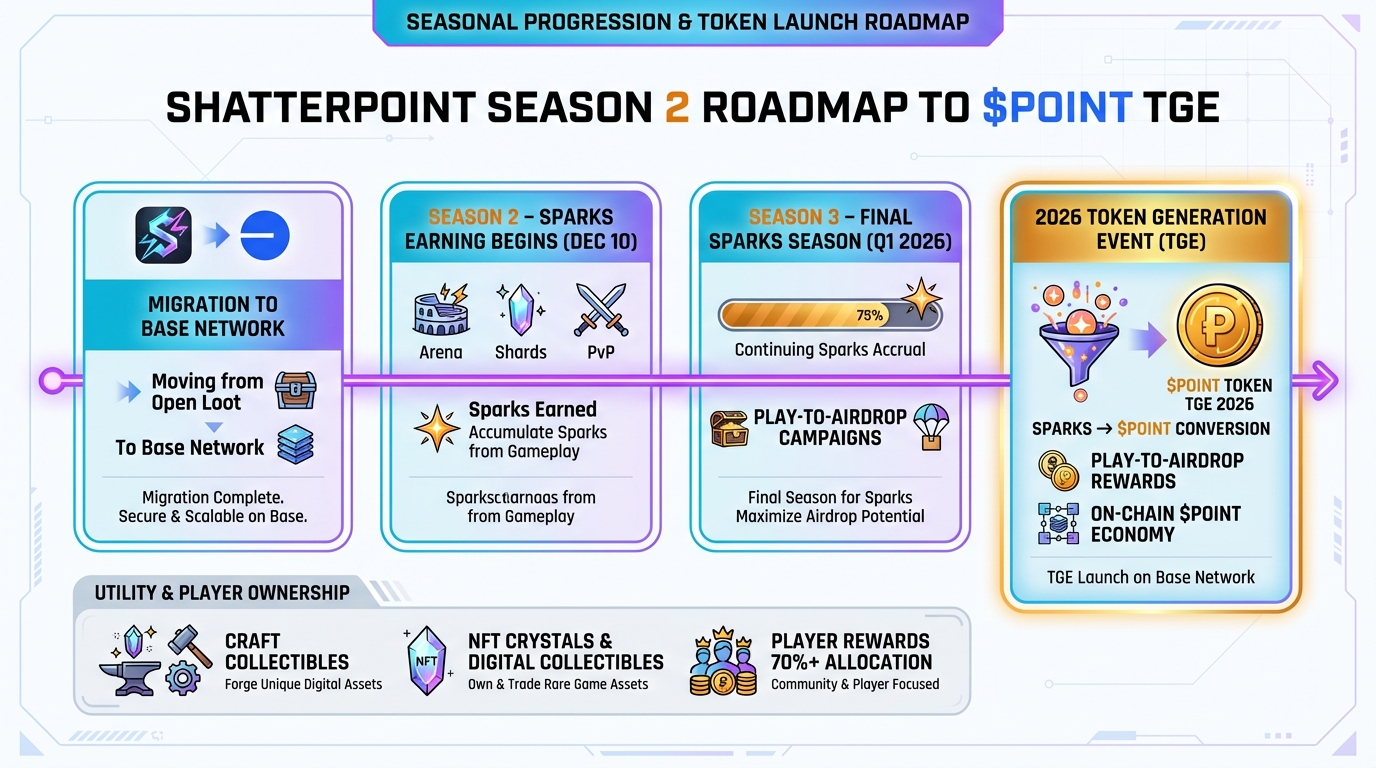

John (Analyst): In the ever-evolving GameFi market, where projects promise moonshots but often deliver rugs, Shatterpoint’s move to the Base network and its upcoming Token Generation Event (TGE) in 2026 caught my eye. With Season 2 launching on December 10, 2025, this RPG-MOBA hybrid isn’t just another play-to-earn gimmick—it’s positioning itself with a play-to-airdrop model that could yield real ROI if the tokenomics hold up. I’ve crunched the numbers using tools like Genspark for a deep-dive into their whitepaper and on-chain data from Dune Analytics. Let’s dissect if this is sustainable or just hype.

Lila (Gamer): Whoa, John, ease up on the cynicism! As a guild manager, I’m excited about Shatterpoint because it’s mobile-friendly and fun—think fast-paced battles with hero NFTs you can actually level up and trade. But yeah, the earning side via Sparks converting to $POINT tokens sounds promising for players like me who want to grind without breaking the bank.

The “Before” State: From Web2 Sunk Costs to Web3 Ownership

John (Analyst): Remember the old days of Web2 gaming? You’d sink hundreds of hours into something like League of Legends, buying skins and champions that were basically digital wallpaper—locked to your account, worthless if the servers shut down. No secondary market, no real ownership; it’s like renting a Ferrari you can never sell. Enter Web3 GameFi like Shatterpoint: your heroes are NFTs on the Base blockchain (a layer-2 Ethereum solution for low gas fees), truly owned in your wallet. Trade them on marketplaces like OpenSea, or stake them for yields. The shift? From sunk costs to potential profits. Guilds can even use tools like Gamma to create presentation slides for recruitment strategies, turning communities into earning machines.

Lila (Gamer): Exactly! In Web2, my epic sword in an MMORPG vanishes if the game dies. Here, my Shatterpoint hero NFT? I can sell it on Magic Eden for real crypto if I quit. It’s empowering—feels like upgrading from renting games to owning a piece of the ecosystem.

Core Mechanism: Token Economy Breakdown

John (Analyst): Shatterpoint’s token economy revolves around $POINT, set for TGE in Q1 2026 after Seasons 1-3. Think of it like a game’s gold system but on-chain: Sparks (earned through gameplay like quests and leaderboards) act as a faucet, converting to $POINT post-TGE. Sinks include upgrading NFTs or in-game purchases, controlling inflation—crucial to avoid the death spiral we saw in Axie Infinity. Based on whitepaper details from nftplaygrounds.com, it’s deflationary with burns on transactions. Sustainability? Moderate; they’re on Base for cheap tx (gas fees around $0.01), but watch for token unlocks via TokenUnlocks app to predict dumps. Projected ROI? If adoption hits, early airdrop farmers could see 5-10x on converted Sparks, but NFA—volatility is high.

Lila (Gamer): From a player’s view, it’s like earning XP that turns into real money. Grind matches, collect Sparks, upgrade your hero—boom, more earnings. The matchmaking update in Season 2 (per egamers.io) makes it fairer, reducing frustration.

Use Cases and Strategies: Maximizing ROI in Shatterpoint

John (Analyst): Strategy 1: Airdrop Farming—Play Seasons 2-3 aggressively to max Sparks. Convert at TGE for instant liquidity; aim for top leaderboards using Chainlink VRF for fair RNG in battles. Watch floor prices on DappRadar—buy low-entry NFTs now at $10-50 for upgrades. ROI potential: 200%+ if $POINT lists strong on Binance-like exchanges.

Lila (Gamer): Strategy 2: Guild Building—Recruit via content marketing. Use Revid.ai to make viral TikTok shorts of epic wins, grow your guild, and share Sparks earnings. It’s like forming a raid team but with crypto splits—sustainable for casual players.

John (Analyst): Strategy 3: Long-Term Staking—Post-TGE, stake $POINT for yields (estimated 20-50% APR based on similar projects). Learn the smart contracts first with Nolang to audit for bugs. Hedge by diversifying into liquidity pools—add $POINT/ETH pairs for fees, but beware impermanent loss.

Lila (Gamer): These aren’t just theories; I’ve seen guilds in similar games like Fableborne (with $POWER TGE) turn small investments into steady income.

Comparison: Traditional Gaming vs. Shatterpoint GameFi

| Feature | Traditional Game (Web2) | This GameFi Project (Web3) |

|---|---|---|

| Ownership | Platform-owned; items can be revoked or lost on shutdown | True NFT ownership on Base blockchain; transferable anytime |

| Tradability | Limited or none; no real secondary market | Freely tradable on OpenSea/Magic Eden; real crypto value |

| Earnings | None; play for fun only, with in-app purchases as sunk costs | Play-to-airdrop Sparks to $POINT; potential staking yields and ROI |

Conclusion: Risks, Rewards, and the Road Ahead

John (Analyst): Shatterpoint’s roadmap to TGE 2026 looks solid with Base integration and deflationary mechanics, but risks abound—market dumps, regulatory shifts, or low adoption could tank $POINT. DYOR using on-chain tools; potential rewards include high ROI for early players, but it’s high-risk like all GameFi.

Lila (Gamer): For gamers, the fun loop and earning potential make it worth a shot. Automate your airdrop claims with Make.com to stay on top—let’s build sustainable play!

👨💻 Author: SnowJon (Web3 & AI Practitioner / Investor)

A researcher who leverages knowledge gained from the University of Tokyo Blockchain Innovation Program to share practical insights on Web3 and AI technologies. While working as a salaried professional, he operates 8 blog media outlets, 9 YouTube channels, and over 10 social media accounts, while actively investing in cryptocurrency and AI projects.

His motto is to translate complex technologies into forms that anyone can use, fusing academic knowledge with practical experience.

*This article utilizes AI for drafting and structuring, but all technical verification and final editing are performed by the human author.

🛑 Disclaimer

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry high risks. DYOR (Do Your Own Research).

▼ Recommended Tools for Web3 & AI

- 🔍 Genspark: AI agent for researching Tokenomics & Whitepapers.

- 📊 Gamma: Generate Guild slides & strategies instantly.

- 🎥 Revid.ai: Create viral GameFi content for TikTok/Shorts.

- 👨💻 Nolang: AI tutor for understanding Blockchain/Smart Contracts.

- ⚙️ Make.com: Automate crypto alerts and data collection.