Curious about Providence GameFi? Dive into its P2E tokenomics, uncover ROI potential, and master strategies for early token access.#GameFi #Tokenomics #Web3Gaming

Quick Video Breakdown: This Blog Article

This video clearly explains this blog article.

Even if you don’t have time to read the text, you can quickly grasp the key points through this video. Please check it out!

If you find this video helpful, please follow the YouTube channel “GameFi+Plus,” which delivers daily news.

https://www.youtube.com/@GameFiPulse

Read this article in your native language (10+ supported) 👉

[Read in your language]

Providence Opens Community Phase Token Registrations: A Deep Dive into GameFi Tokenomics, P2E Sustainability, and ROI Potential

🎯 Difficulty: Advanced (DeFi Knowledge Req)

💰 Investment: Low Entry (Community-Based Access)

👍 Recommended For: Token Investors, GameFi Analysts, Web3 Community Builders

As the GameFi sector rebounds in late 2025, with projects like FLOKI leading market cap rankings per CoinGecko data, Providence’s community phase token registrations stand out. This initiative targets engaged users—testers, social participants, and feedback providers—offering exclusive access to tokens before broader sales. But is this a sustainable model or just another hype cycle? We’ll dissect the token utility, drawing from market analysis and tools like Genspark for whitepaper deep-dives.

John (Analyst): Look, if a project like Providence is screaming “community-first token sale,” I roast it right out the gate. We’ve seen too many “exclusive phases” that inflate supply and crash prices post-launch. But let’s audit this: Built on what seems to be a blockchain like Ethereum or a layer-2 (details pending whitepaper confirmation via Dune Analytics), the tokens likely fuel in-game utilities. Sustainability? Check inflation controls—no endless minting, please.

Lila (Gamer): John, you’re cynical, but for players, this is exciting! If you’ve tested Providence or engaged on socials, registering could mean early tokens for gameplay boosts.

The “Before” State: Web2 Gaming vs. Web3 Revolution

In traditional Web2 gaming, think Fortnite or League of Legends: You grind for skins or items, but they’re locked in the company’s servers. Server shutdown? Poof, your “assets” vanish—pure sunk costs. No real ownership, no secondary market to sell that rare sword for actual cash.

Enter Web3 GameFi like Providence: True ownership via NFTs on your wallet, tradable on marketplaces like OpenSea. Tokens earned? They’re yours to stake (lock up for rewards) or trade in liquidity pools (pots of money enabling instant swaps). This shifts from “pay-to-play” to “play-to-earn,” where your time translates to real value. For guild building, tools like Gamma help create presentation slides to recruit members and strategize.

John (Analyst): Exactly. But beware: Web3 isn’t magic. Gas fees (transaction costs on chains like Ethereum) can eat into profits—current averages around $5-10 per swap, per DappRadar. Providence’s community phase might minimize this by prioritizing low-entry participants.

Core Mechanism: Token Economy Breakdown

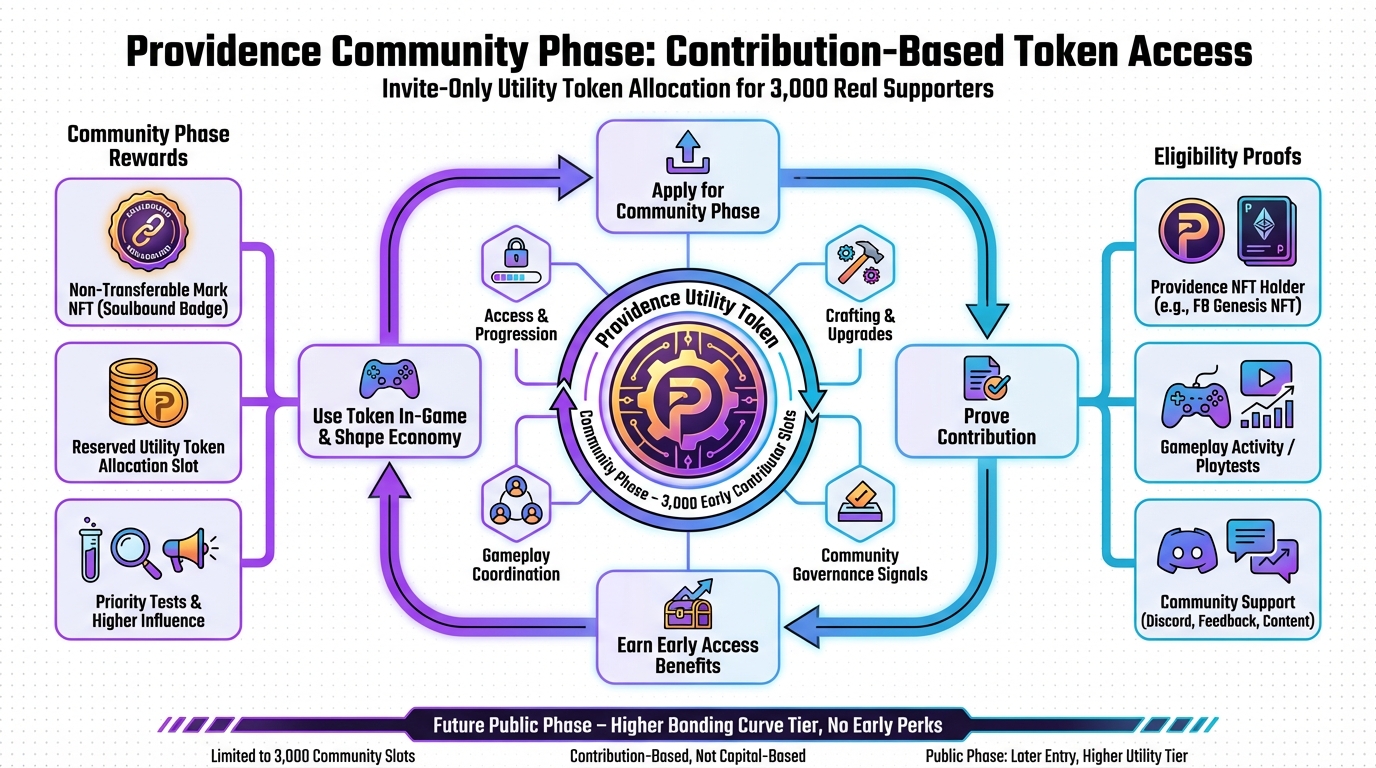

In Providence’s token economy, think of it like a balanced ecosystem: Faucets (ways tokens enter circulation, like gameplay rewards or airdrops) versus sinks (mechanisms that remove tokens, such as burning for upgrades or staking lockups). From EGamers.io reports, this community phase focuses on historical contributors, potentially capping supply to control inflation—crucial for long-term value.

John (Analyst): Let’s get specific. If tokens follow a dual-model (governance + utility, akin to projects on Immutable X), ROI could hinge on vesting schedules—check TokenUnlocks for unlock events. Sustainability? Look for deflationary mechanics; without them, it’s a Ponzi waiting to pop. Projected APR around 20-50% from staking, but factor in market volatility.

Lila (Gamer): For us players, it’s about looping rewards into better gear. Earn tokens from quests, use them to mint NFTs, then flip on Magic Eden for profit.

Inflation control is key—Providence might use Chainlink VRF for fair randomness in rewards, avoiding overissuance. Roadmap-wise, post-community phase could include public sales and gameplay expansions, per recent GameFi news on CoinMarketCap.

Use Cases and Strategies: Maximizing Profit in Providence

To squeeze real value, here are three concrete strategies, blending investor logic with gamer tactics. Remember, this is NFA—crypto is high-risk.

- Early Registration Flip: If eligible (via form on Providence’s site), register for tokens at discounted rates. Hold until public launch, then sell on exchanges during hype peaks. Actionable: Use Dune Analytics to monitor on-chain volume; aim for 2-5x ROI if adoption spikes. For guild marketing, leverage Revid.ai to create viral shorts promoting your strategy.

- Staking for Passive Yield: Lock tokens post-acquisition for rewards. Strategy: Compound by reinvesting yields into NFTs for gameplay multipliers. Watch for floor prices starting at $10-50 on secondary markets. To understand the smart contracts behind this, dive into Solidity with Nolang.

- Community Building for Airdrops: Engage deeply—test games, provide feedback—to qualify for future drops. Build a guild, recruit via socials, and share earnings (scholarship model, like Axie Infinity). Potential ROI boost: 30% from referral bonuses. Automate alerts with Make.com for timely registrations.

Highlight: Always DYOR—use Genspark to verify team creds and avoid rugs.

Comparison: Traditional Gaming vs. Providence GameFi

| Feature | Traditional Game (Web2) | This GameFi Project (Web3) |

|---|---|---|

| Ownership | Company-controlled; no true rights | NFT-based; wallet-owned and verifiable |

| Tradability | Limited or none; in-game only | Open marketplaces like OpenSea; real liquidity |

| Earnings | Virtual rewards with no real-world value | Tokens/NFTs convertible to crypto; potential ROI via staking |

John (Analyst): See? Web3 flips the script, but Providence must deliver on roadmap to avoid Web2 pitfalls like abandoned projects.

Conclusion: Risks, Rewards, and Final Thoughts

Providence’s community phase could reward early believers with sustainable P2E mechanics, potentially yielding solid ROI if tokenomics hold (e.g., controlled supply leading to price stability). Rewards? Exclusive access, governance votes, and earning potential in a growing sector—GameFi tokens are rallying per CoinMarketCap.

But risks abound: Market dumps, regulatory shifts (like EU’s MiCA impacting sell pressure, as in Pi Network cases), or rug pulls. DYOR thoroughly—crypto is volatile, NFA. For automating airdrop claims, try Make.com.

Lila (Gamer): If it’s fun and fair, I’m in. But yeah, play smart!

👨💻 Author: SnowJon (Web3 & AI Practitioner / Investor)

A researcher who leverages knowledge gained from the University of Tokyo Blockchain Innovation Program to share practical insights on Web3 and AI technologies. While working as a salaried professional, he operates 8 blog media outlets, 9 YouTube channels, and over 10 social media accounts, while actively investing in cryptocurrency and AI projects.

His motto is to translate complex technologies into forms that anyone can use, fusing academic knowledge with practical experience.

*This article utilizes AI for drafting and structuring, but all technical verification and final editing are performed by the human author.

🛑 Disclaimer

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry high risks. DYOR (Do Your Own Research).

▼ Recommended Tools for Web3 & AI

- 🔍 Genspark: AI agent for researching Tokenomics & Whitepapers.

- 📊 Gamma: Generate Guild slides & strategies instantly.

- 🎥 Revid.ai: Create viral GameFi content for TikTok/Shorts.

- 👨💻 Nolang: AI tutor for understanding Blockchain/Smart Contracts.

- ⚙️ Make.com: Automate crypto alerts and data collection.

References & Further Reading

- Providence Unveils Community Token Initiative – EGamers.io

- GameFi News: Web3 Gaming Tokens Rally – CoinMarketCap

- Providence Opens Community Phase Token Registrations – PlayToEarn