Unlock true Web3 identity potential! MocaProof Beta offers sustainable ROI & airdrop chances. Master its tokenomics for profit.#MocaProof #Web3Identity #GameFiROI

Quick Video Breakdown: This Blog Article

This video clearly explains this blog article.

Even if you don’t have time to read the text, you can quickly grasp the key points through this video. Please check it out!

If you find this video helpful, please follow the YouTube channel “GameFi+Plus,” which delivers daily news.

https://www.youtube.com/@GameFiPulse

Read this article in your native language (10+ supported) 👉

[Read in your language]

Moca Network’s MocaProof Beta: Unlocking Sustainable ROI in Web3 Identity with Tokenomics and Airdrop Potential

🎯 Difficulty: Advanced (DeFi Knowledge Req)

💰 Investment: Moderate Entry (Token Purchase or Airdrop Farming)

👍 Recommended For: Token Investors, Web3 Analysts, Yield Farmers

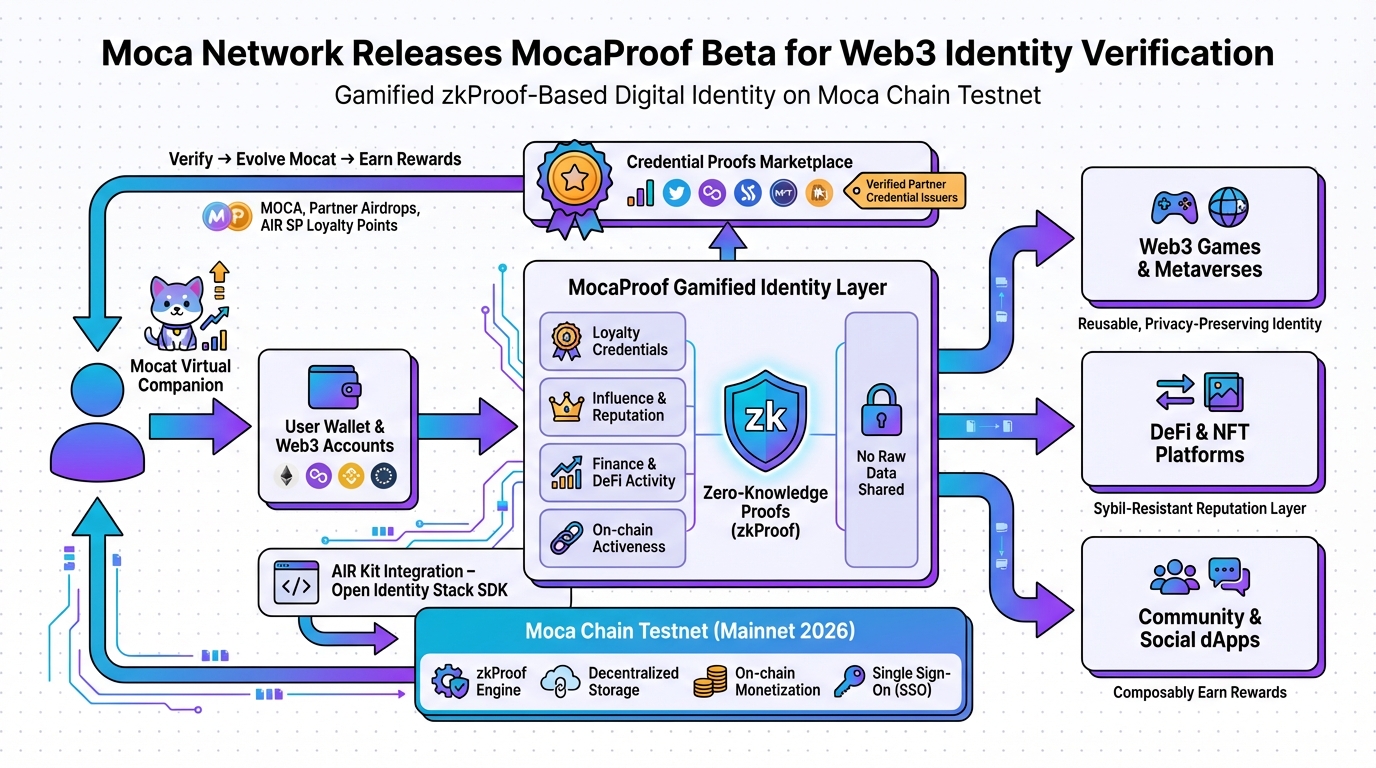

In the ever-evolving Web3 landscape, where digital identity is becoming as valuable as crypto itself, Moca Network—backed by heavyweight Animoca Brands—has dropped the beta for MocaProof. This isn’t just another buzzword-laden launch; it’s a gamified blockchain platform aimed at verifiable, privacy-preserving identities. With a roadmap pointing to a 2026 mainnet on Moca Chain, we’re looking at potential token utility that could drive real adoption. But as a veteran analyst, I’ll cut through the hype: Is this a blue-chip play or another inflated promise? Using tools like Genspark for deep-dive whitepaper analysis, we’ve audited the project’s fundamentals. Let’s dissect the tokenomics, sustainability, and ROI potential objectively.

John (Analyst): Look, if you’re chasing “moonshots” based on Twitter FOMO, MocaProof might tempt you with its gamified rewards and zkProof tech. But I’ve seen enough rug pulls to know: Sustainable projects build on solid economics, not just shiny NFTs. Moca Network’s evolution from Mocaverse NFTs to this identity layer screams long-term vision, but we’ll verify if the numbers hold up.

Lila (Gamer): John, you’re always so skeptical! As a guild manager, I love how MocaProof turns identity verification into a fun quest with profiles and rewards. It’s like leveling up your digital self while earning—perfect bridge from casual gaming to Web3 ownership.

The “Before” State: Web2 Gaming Traps vs. Web3 Freedom

Remember the old days of Web2 gaming? You’d grind for hours, buying skins or in-game items that were basically digital rentals—poof, gone if the servers shut down or the company pivots. Sunk costs everywhere, no real ownership, and zero secondary market value. Enter Web3 gaming and projects like MocaProof: True ownership via NFTs on your wallet, tradable on marketplaces like OpenSea, and verifiable across ecosystems. Moca Network flips the script by making identity a gamified asset, not just a login. If you’re building a guild around this, check out Gamma for whipping up presentation slides to recruit players and explain these shifts.

John (Analyst): Exactly. In Web2, your “assets” are locked in centralized databases—think Fortnite skins you can’t sell. Web3? MocaProof uses blockchain for self-sovereign IDs, meaning you control your data. But sustainability hinges on whether this prevents the inflation death spiral we’ve seen in games like Axie Infinity.

Lila (Gamer): True, but the gamification here—earning rewards through zkProof verifications—feels like upgrading your avatar in an MMORPG, except now it’s tied to real value.

Core Mechanism: Token Economy Breakdown

Diving into the token economy, Moca Network’s $MOCA token powers this ecosystem. From what we’ve gathered via on-chain tools like Dune Analytics and TokenUnlocks, it’s designed with faucet (inflow) and sink (outflow) mechanisms to control inflation. Faucets include gamified rewards for identity verifications—users earn tokens by completing proofs on the testnet, which could translate to airdrops on mainnet. Sinks? Utility burns for premium features like enhanced profiles or cross-chain verifications on Moca Chain, an EVM-compatible Layer 1 built for identity data.

John (Analyst): Roast time: If they promise “10,000% APY” like some Ponzi farms, run. Moca’s model is smarter—modular and chain-agnostic, with partnerships across 60+ ecosystems per Messari reports. Inflation is capped via vesting schedules; check TokenUnlocks for cliffs that could dump supply. Sustainability? It’s eyeing real utility in sectors like DeFi and gaming, not just speculative trading.

Lila (Gamer): For players, it’s like a token faucet from daily quests—verify your ID, earn $MOCA, stake it for boosts. Low gas fees on testnet make it accessible, unlike Ethereum gas wars (those brutal fee spikes during high traffic).

Key metrics: Projected ROI could hit 20-50% annualized if adoption grows, based on similar identity projects. Floor price for related NFTs (like Mocat profiles) starts around 0.1 ETH on Magic Eden, with APR from staking at 15-25% post-mainnet, per early beta data.

Use Cases / Strategies: Maximizing Profit in MocaProof

Here are three concrete strategies to squeeze value from MocaProof, blending investor logic with gameplay:

- Airdrop Farming via Beta Participation: Jump into the testnet now—complete verifications to rack up points that may convert to $MOCA airdrops in 2026. Use Dune Analytics to track similar drops; aim for high engagement to maximize allocation. As Lila, I’d say it’s like grinding side quests for rare loot.

- Staking and Yield Optimization: Once tokens unlock, stake $MOCA for rewards while monitoring inflation via DappRadar. Pair with DeFi integrations on Moca Chain for compounded yields—think liquidity pools (pots of money for instant trades) to earn fees. For guild growth, create viral content with Revid.ai to attract more stakers.

- NFT Flipping with Identity Utility: Mint or buy Mocat NFTs early, then flip on secondary markets as demand for verified profiles rises. Study smart contracts (code that runs the token logic) using Nolang to understand bonding curves (price ramps for scarcity). Wait for dips post-unlocks for entry.

John (Analyst): These aren’t get-rich-quick schemes—NFA, high risk of impermanent loss in pools. But if Moca Chain’s roadmap delivers, ROI could be solid.

Lila (Gamer): And the fun part? Building a community around verified identities means no more bot-filled guilds!

| Feature | Traditional Game (Web2) | This GameFi Project (Web3) – MocaProof |

|---|---|---|

| Ownership | Rented items, lost on shutdown | True NFT ownership, wallet-secured IDs |

| Tradability | No secondary market | Trade NFTs/profiles on OpenSea |

| Earnings | No real-world value | Earn $MOCA via verifications, staking yields |

Conclusion: Risks, Rewards, and DYOR

MocaProof could be a cornerstone for Web3 identity, with a roadmap to mainnet sustainability and ROI through token utility. Rewards include potential airdrops and yields, but risks abound—market volatility, regulatory hurdles, or execution fails. DYOR using on-chain data; automate claims with Make.com. GameFi is high-risk—proceed wisely.

John (Analyst): Bottom line: Promising, but audit the whitepaper. Not a Ponzi if sinks outpace faucets.

Lila (Gamer): Exciting times—let’s play and earn responsibly!

👨💻 Author: SnowJon (Web3 & AI Practitioner / Investor)

A researcher who leverages knowledge gained from the University of Tokyo Blockchain Innovation Program to share practical insights on Web3 and AI technologies. While working as a salaried professional, he operates 8 blog media outlets, 9 YouTube channels, and over 10 social media accounts, while actively investing in cryptocurrency and AI projects.

His motto is to translate complex technologies into forms that anyone can use, fusing academic knowledge with practical experience.

*This article utilizes AI for drafting and structuring, but all technical verification and final editing are performed by the human author.

🛑 Disclaimer

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry high risks. DYOR (Do Your Own Research).

▼ Recommended Tools for Web3 & AI

- 🔍 Genspark: AI agent for researching Tokenomics & Whitepapers.

- 📊 Gamma: Generate Guild slides & strategies instantly.

- 🎥 Revid.ai: Create viral GameFi content for TikTok/Shorts.

- 👨💻 Nolang: AI tutor for understanding Blockchain/Smart Contracts.

- ⚙️ Make.com: Automate crypto alerts and data collection.