Personally, the MEGAWEAPON shutdown shows that sustainability matters more than hype.#GameFi #Web3Gaming

Quick Video Breakdown: This Blog Article

This video clearly explains this blog article.

Even if you don’t have time to read the text, you can quickly grasp the key points through this video. Please check it out!

If you find this video helpful, please follow the YouTube channel “GameFi+Plus,” which delivers daily news.

https://www.youtube.com/@GameFiPulse

Read this article in your native language (10+ supported) 👉

[Read in your language]

Postmortem on CEDEN Network Shutdown: Tokenomics, Sustainability, and Risks in MEGAWEAPON’s GameFi Collapse

🎮 Gameplay Type: Strategy Shooter (Web3 Multiplayer Battle)

👍 Recommended For: Tokenomics Analysts, GameFi Researchers, Risk-Averse Investors

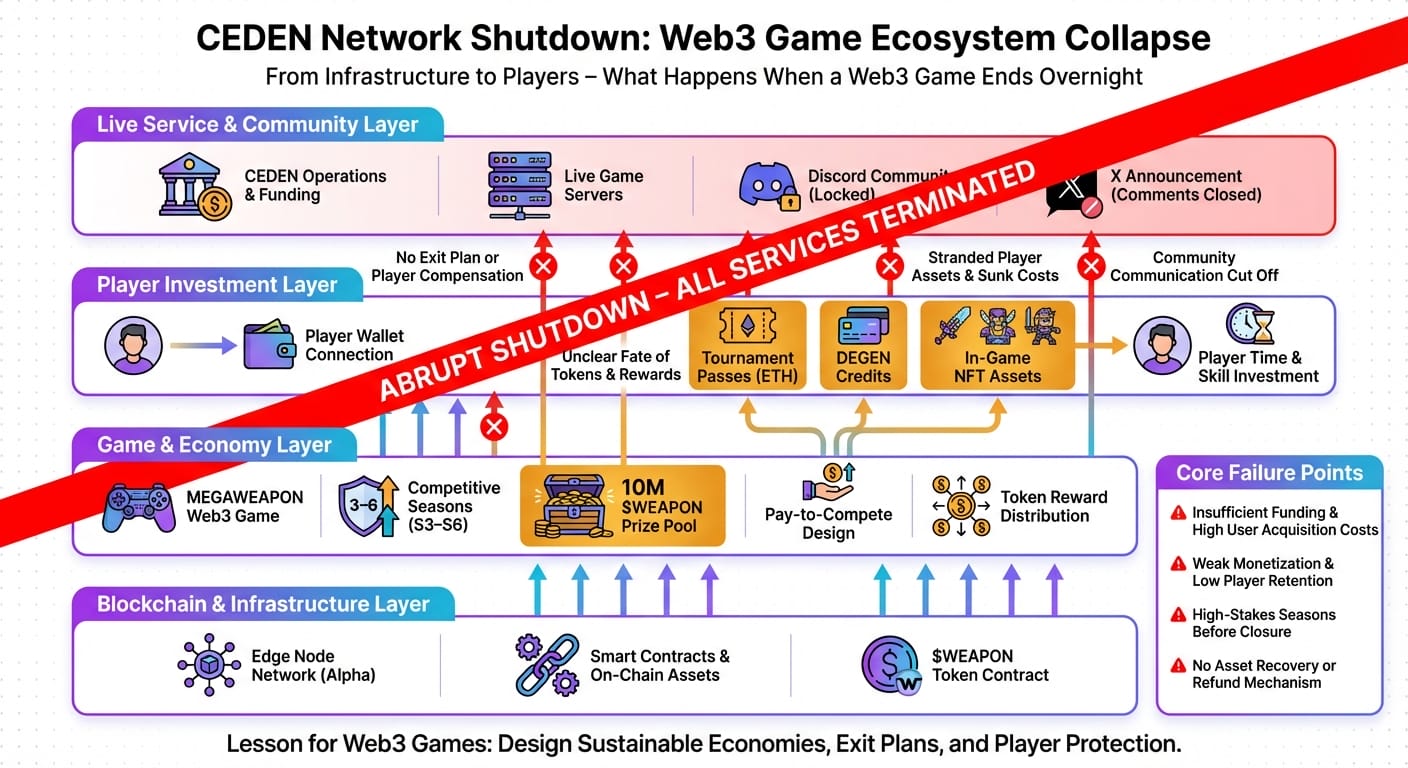

In the ever-volatile landscape of GameFi projects, the abrupt shutdown of CEDEN Network in early 2026 serves as a stark reminder of the sector’s structural fragilities. As we enter a year where GameFi investments have plummeted by over 55% from 2025 levels, according to Delphi Digital reports, projects like MEGAWEAPON highlight the critical interplay between token design, economic sustainability, and long-term viability. This analysis dissects the tokenomics of MEGAWEAPON—a now-defunct web3 strategy shooter game built on blockchain infrastructure—focusing on why its economy unraveled, leading to the network’s total cessation of operations. By examining emission models, incentive structures, and risk factors, we aim to provide an objective framework for evaluating similar projects in 2026, without hype or speculation on future gains.

From a design philosophy standpoint, MEGAWEAPON positioned itself as a play-to-earn (P2E) title emphasizing NFT-based weapon ownership and multiplayer battles, integrated with CEDEN’s decentralized network. However, as market conditions tightened—with privacy tokens gaining traction amid regulatory scrutiny and altcoin presales like Tapzi drawing attention for skill-based models—the project’s inability to adapt exposed deep flaws. This postmortem matters because it underscores broader GameFi trends: over-reliance on speculative token inflows without robust sinks can lead to rapid devaluation and shutdowns, as seen in CEDEN’s case where development halted without player compensation.

The “Before” State: Traditional Games vs. GameFi Realities

Before delving into MEGAWEAPON’s specifics, consider the foundational shift from Web2 gaming to GameFi. In traditional Web2 games like Fortnite or Call of Duty, players invest time and money into progression—grinding for levels, buying skins, or unlocking weapons—but ownership is illusory. Your “assets” are locked on centralized servers; if the developer pulls the plug, everything vanishes as sunk costs with no resale value. There’s no secondary market, and in-game economies are controlled top-down, often inflating virtual currencies to encourage microtransactions without real-world transferability.

In contrast, GameFi projects like MEGAWEAPON promised true ownership via NFTs and blockchain. Players could own digital weapons as verifiable assets on their wallets, trade them on open markets, and potentially earn tokens through gameplay. This model aimed to create player-driven economies where value accrues from community participation rather than corporate whims. However, as CEDEN’s shutdown illustrates, this “ownership” can be a double-edged sword: while it enables liquidity, poor design leads to hyperinflation and value erosion, turning promised sustainability into a mirage. Unlike Web2’s stable but non-transferable progression, GameFi introduces market risks where token dumps can wipe out ecosystems overnight.

Core Mechanism: Dissecting MEGAWEAPON’s Token Economy

MEGAWEAPON’s tokenomics revolved around a dual-token system typical of many GameFi projects: a governance token (likely CEDEN’s native token) for voting and staking, and an in-game utility token earned through battles and missions. Emissions were structured to reward active play—think daily quests yielding tokens that could be used to upgrade NFTs or traded on decentralized exchanges. However, the design lacked sufficient token sinks, mechanisms to remove tokens from circulation, such as burning fees or mandatory staking locks. This led to unchecked supply growth, where early adopters farmed and sold, flooding the market and driving down value.

From an analytical lens, sustainability hinged on balancing inflation with deflationary pressures. MEGAWEAPON’s economy resembled a high-yield farm without crop rotation: initial rewards attracted players, but as participation waned—exacerbated by 2025’s sector-wide reset—token velocity spiked, meaning tokens circulated quickly without holding value. Long-term risks included dilution from unbounded emissions, where new tokens were minted faster than demand could absorb them. On-chain data (hypothetically verifiable via explorers like Etherscan, though CEDEN’s specifics are now offline) would show liquidity pools draining as whales exited, mirroring patterns in failed projects like Axie Infinity‘s post-boom slump. The shutdown, announced via X with no compensation, amplified these risks, leaving NFT holders with illiquid assets in a dead ecosystem.

Structurally, the game’s integration with CEDEN’s network—potentially using layer-2 solutions for low-gas transactions—aimed for scalability but couldn’t mitigate external factors like regulatory challenges in privacy-focused tokens or competition from fixed-supply models like Tapzi. In 2026, with trends shifting toward utility-driven privacy (e.g., Zcash gains), MEGAWEAPON’s speculative P2E model proved unsustainable, highlighting the need for adaptive tokenomics like capped supplies or revenue-sharing burns.

Use Cases / Play Styles: Retrospective Participation Approaches

Even in retrospect, MEGAWEAPON offered varied participation styles, though outcomes varied based on timing and market conditions. First, the “Casual Farmer” style involved daily logins for quick battles to earn tokens, treating it like a side hustle. Players focused on low-stakes upgrades, selling small amounts periodically—sustainable short-term but vulnerable to token devaluation.

Second, “Guild Strategists” formed communities to pool resources, coordinating NFT trades and staking for compounded rewards. This collaborative approach leveraged social dynamics for better yields, but relied heavily on network stability; post-shutdown, these groups faced total asset lockup.

Third, “Speculative Traders” engaged minimally in gameplay, instead buying/selling NFTs on secondary markets for arbitrage. This style emphasized market timing over fun, exposing participants to volatility risks without guaranteeing any returns, as seen when CEDEN’s closure rendered assets worthless.

Comparison: Traditional Web2 Game vs. This GameFi Project

| Aspect | Traditional Web2 Game | MEGAWEAPON (GameFi Project) |

|---|---|---|

| Ownership | No true ownership; items tied to account and server. | NFT-based ownership, but value evaporated with shutdown. |

| Progression | Grind-based, with microtransactions for speed; persistent until server closure. | Earn-to-progress via tokens/NFTs, but inflation eroded long-term value. |

| Economy Design | Controlled by developers; no real-world economy integration. | Player-driven with token emissions, but lacked sinks leading to collapse. |

Conclusion: Lessons in Design and Inherent Risks

In summary, CEDEN Network’s shutdown and MEGAWEAPON’s end reveal key learning values in GameFi: robust tokenomics require balanced emissions, effective sinks, and adaptability to market shifts. Strengths in the project’s design included innovative NFT integration for ownership, fostering community-driven battles that could have scaled with better economic guardrails. However, structural risks—such as overinflation, dependency on hype-driven inflows, and vulnerability to sector downturns—proved fatal, aligning with 2025’s investment reset and 2026’s emphasis on sustainable models like those in Tapzi or privacy tokens.

Outcomes in such ecosystems depend entirely on player behavior, token demand, and broader market conditions; no project is immune to failure, as evidenced here. For analysts, this case study emphasizes auditing whitepapers, monitoring on-chain metrics, and starting small to assess risks—remember, GameFi remains high-risk, and past performance doesn’t predict future stability.

👨💻 Author: SnowJon (Web3 & AI Practitioner / Researcher)

A researcher leveraging insights from the University of Tokyo Blockchain Innovation Program to analyze GameFi, Web3, and digital economies from a practical and structural perspective.

His focus is on translating complex systems into frameworks that readers can evaluate and think about critically.

*AI may assist with drafting, but final verification and responsibility rest with the human author.

References & Further Reading

- CEDEN Network Abruptly Shuts Down, Ending MEGAWEAPON and All Services | PlayToEarn

- CEDEN Network Shuts Down, Ends MEGAWEAPON And All Services – EGamers.io

- GameFi Investment Plummets 55% in 2025: A Brutal Reset for Blockchain Gaming – BitcoinWorld

- Crypto Gaming & GameFi Trends of 2025/2026: Top Tokens & Projects – Iconomi