Personally, High Roller is interesting. Real asset ownership beats renting gameplay.#GameFi #Web3

Quick Video Breakdown: This Blog Article

This video clearly explains this blog article.

Even if you don’t have time to read the text, you can quickly grasp the key points through this video. Please check it out!

If you find this video helpful, please follow the YouTube channel “GameFi+Plus,” which delivers daily news.

https://www.youtube.com/@GameFiPulse

Read this article in your native language (10+ supported) 👉

[Read in your language]

High Roller’s Partnership with Power Protocol: Analyzing Web3 Incentives in GameFi Economies

🎮 Gameplay Type: Casino / Incentive-Driven GameFi

👍 Recommended For: Tokenomics Analysts, Crypto Investors, Casino Economy Researchers

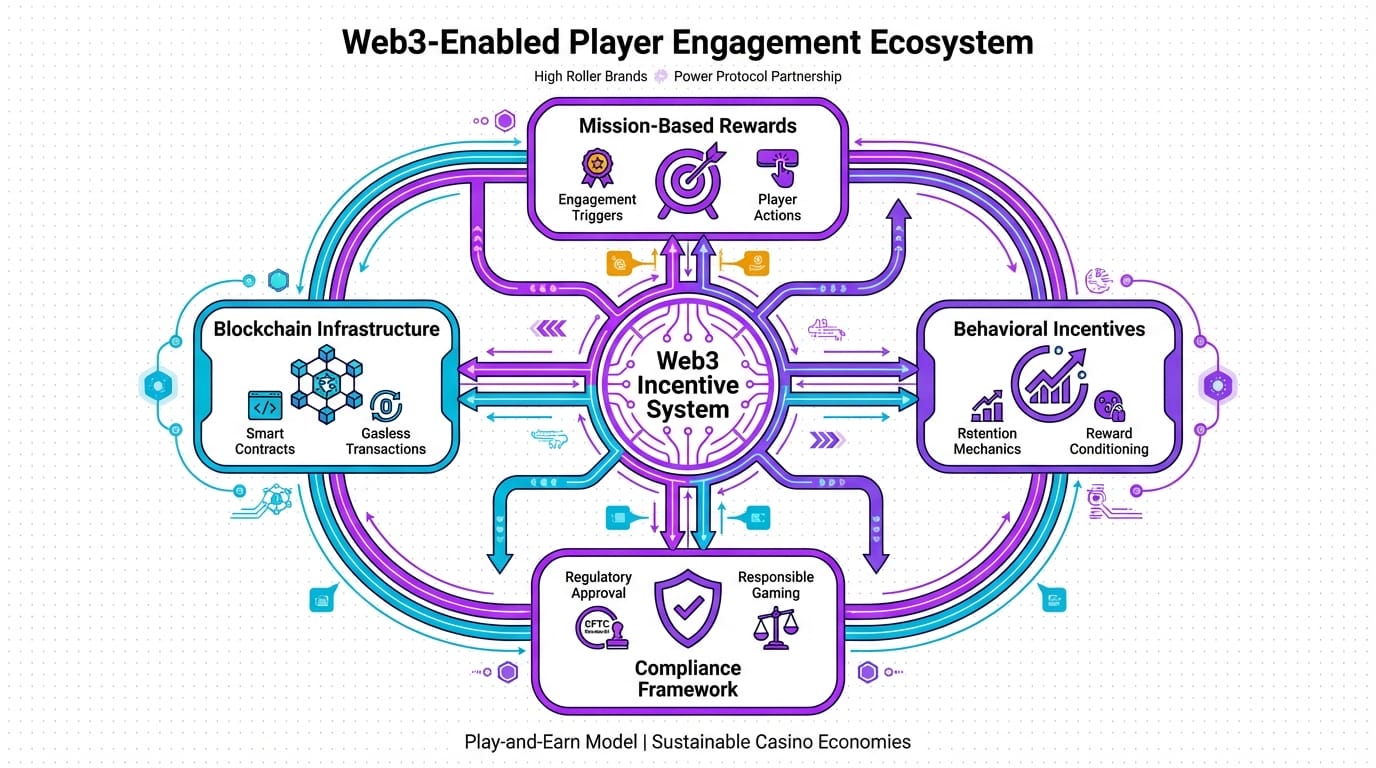

Lila (Gamer): Hey everyone, with the online casino space heating up in 2026, High Roller Technologies—a NYSE-listed operator of premium casino brands—has teamed up with Power Protocol to dip into Web3 incentives. This isn’t just another buzzword partnership; it’s about reshaping player engagement in regulated digital markets. But as always, we’re here to cut through the noise.

John (Analyst): Exactly, Lila. From a market context, the GameFi sector has matured since the 2021 hype, but casino integrations like this raise questions about sustainability. High Roller runs over 6,000 games, and partnering with Power Protocol aims to introduce blockchain-based rewards. Think of it as layering token economies onto traditional gambling mechanics—potentially using things like NFTs for exclusive access or tokens for loyalty sinks. But let’s be clear: this is exploratory, based on recent announcements. We’re analyzing the structural philosophy here, not hyping moonshots. Remember, GameFi is high-risk, and outcomes depend on market conditions. Also, a critical note for our Japanese readers: Online casino activities, including betting or slots, are strictly regulated or illegal in Japan. This article is purely informational—consult local laws before engaging.

The “Before” State: Web2 Casinos vs. Emerging GameFi Models

Lila (Gamer): In traditional Web2 casinos, you log in, play slots or roulette, and maybe rack up loyalty points that vanish if the platform shuts down. It’s like grinding for in-game gold that the developer can wipe out anytime—no real ownership, just sunk costs on entertainment.

John (Analyst): Spot on. Contrast that with GameFi, where blockchain enables true asset ownership via NFTs (non-fungible tokens—unique digital items you actually own in your wallet) or tokens that can be traded on secondary markets. In High Roller’s potential setup, Web3 incentives could mean earning tokens from gameplay that hold value beyond the platform. But here’s the roast: If this turns into another “earn while you bet” scheme without solid sinks, it might inflate faster than a bad poker bluff. We’re looking at press releases from sources like PlayToEarn and GlobeNewswire, dated January 15, 2026, indicating compliance testing across regulated markets—no on-chain data yet, but it’s worth watching for real tokenomics reveals.

Core Mechanism: Dissecting the Potential Token Economy

John (Analyst): Let’s break down the tokenomics logically. Based on similar GameFi projects like Axie Infinity‘s recent pivots (as reported in AI Invest on January 18, 2026), High Roller’s collaboration might involve a dual-token system—perhaps a governance token for voting on incentives and a utility token for in-game rewards. Emission could come from gameplay wins or staking (locking tokens to earn yields, like parking money in a savings account for interest). But the key to sustainability is token sinks—mechanisms that remove tokens from circulation, such as burning fees on bets or upgrading NFTs.

Lila (Gamer): Yeah, imagine playing blackjack and earning tokens that you can use to unlock premium tables or trade for real value. It’s like XP in a RPG, but with blockchain verification—maybe using Chainlink for fair randomness in games to prevent rigging.

John (Analyst): Precisely. Long-term risks include inflation if emissions outpace sinks, leading to value dilution—think printing too much in-game currency until it’s worthless. Sustainability hinges on balanced design; for instance, if Power Protocol integrates something like Immutable X for low-fee transactions, it could reduce barriers. Check on-chain explorers like Etherscan once tokens launch to verify supply caps. No hype here: Historical data from projects like Axie shows how unchecked emissions crashed economies. High Roller’s model, per Investing.com reports from January 15, 2026, emphasizes compliance, which is a green flag for longevity, but watch for unlock schedules that could flood the market.

Use Cases / Play Styles: Realistic Participation Approaches

Lila (Gamer): First, the casual participant: You dip in for fun casino sessions, earning small incentives without heavy commitment. It’s like weekend gaming—play a few rounds, collect tokens, and maybe trade them if the market aligns, but focus on enjoyment over speculation.

John (Analyst): Second, the strategic analyst: Monitor token flows, stake for yields, and engage in governance if available. This style suits those evaluating economy health—start small, verify contracts on official docs, and track metrics like total value locked via dashboards like DefiLlama.

Lila (Gamer): Third, the community builder: Join guilds or forums to collaborate on incentive strategies, perhaps pooling resources for bigger bets. Outcomes vary based on player behavior and external factors—no guarantees, just potential for deeper engagement if the design holds up.

Comparison: Traditional Web2 Casinos vs. This GameFi Project

| Aspect | Traditional Web2 Casino | High Roller’s GameFi with Power Protocol |

|---|---|---|

| Ownership | No true ownership; rewards tied to platform accounts that can be revoked. | Potential NFT-based assets or tokens owned via blockchain wallets, tradeable on secondary markets. |

| Progression | Loyalty points reset or expire; progression is siloed. | Token earnings could compound through staking or upgrades, with cross-platform potential. |

| Economy Design | Centralized, profit-driven by operator; no player input on rewards. | Decentralized incentives with possible governance; focuses on sinks to balance inflation risks. |

Conclusion: Weighing Design Strengths and Risks

John (Analyst): This partnership highlights innovative economy design in GameFi, with strengths in compliance and potential for sustainable sinks like fee burns. Learning value lies in understanding how Web3 can enhance engagement without over-relying on speculation. However, structural risks—such as emission imbalances or regulatory shifts—could undermine longevity. Outcomes depend entirely on player behavior, market conditions, and actual implementations. Evaluate critically, start small if exploring, and always prioritize safety.

Lila (Gamer): It’s an exciting space, but play smart—fun first, analysis second.

👨💻 Author: SnowJon (GameFi / Web3 Researcher)

A researcher leveraging insights from the University of Tokyo Blockchain Innovation Program to analyze GameFi economies and Web3 adoption from a practical, evidence-first perspective.

The focus is translating complicated systems into frameworks readers can evaluate critically—fun factor, token sinks, inflation risk, and sustainability signals.

*AI may assist drafting, but final verification and responsibility rest with the human author.

References & Further Reading

- High Roller Teams Up With Power Protocol to Explore Web3 Incentives – PlayToEarn

- High Roller Technologies and Power Protocol Partner to Introduce Web-3 Enabled Incentive-Driven Engagement – GlobeNewswire

- Axie Infinity Pivots Tokenomics and Web3 Strategy in 2026 – AI Invest

- High Roller Partners with Power Protocol to Explore Web3 Incentives – Investing.com

▼ AI tools to streamline research and content production (free tiers may be available)

Free AI search & fact-checking

👉 Genspark

Recommended use: Quickly verify key claims and track down primary sources before publishing

Ultra-fast slides & pitch decks (free trial may be available)

👉 Gamma

Recommended use: Turn your article outline into a clean slide deck for sharing and repurposing

Auto-convert trending articles into short-form videos (free trial may be available)

👉 Revid.ai

Recommended use: Generate short-video scripts and visuals from your headline/section structure

Faceless explainer video generation (free creation may be available)

👉 Nolang

Recommended use: Create narrated explainer videos from bullet points or simple diagrams

Full task automation (start from a free plan)

👉 Make.com

Recommended use: Automate your workflow from publishing → social posting → logging → next-task creation

※Links may include affiliate tracking, and free tiers/features can change; please check each official site for the latest details.