Why did ChronoForge fail? Dive into the GameFi funding collapse to protect your P2E investments. Understand the Web3 market’s true risks.#GameFi #Web3Gaming #ChronoForge

Quick Video Breakdown: This Blog Article

This video clearly explains this blog article.

Even if you don’t have time to read the text, you can quickly grasp the key points through this video. Please check it out!

If you find this video helpful, please follow the YouTube channel “GameFi+Plus,” which delivers daily news.

https://www.youtube.com/@GameFiPulse

Read this article in your native language (10+ supported) 👉

[Read in your language]

ChronoForge Shutdown: Analyzing the GameFi Funding Collapse and Lessons for P2E Investors in a Volatile Web3 Market

🎯 Difficulty: Advanced (DeFi Knowledge Req) – Requires understanding of blockchain asset ownership and token economies.

💰 Investment: Moderate Entry – Initial NFT purchases and token staking, but high risk due to project shutdown.

👍 Recommended For: Crypto Investors, Tokenomics Analysts, Web3 Gaming Enthusiasts seeking failure case studies.

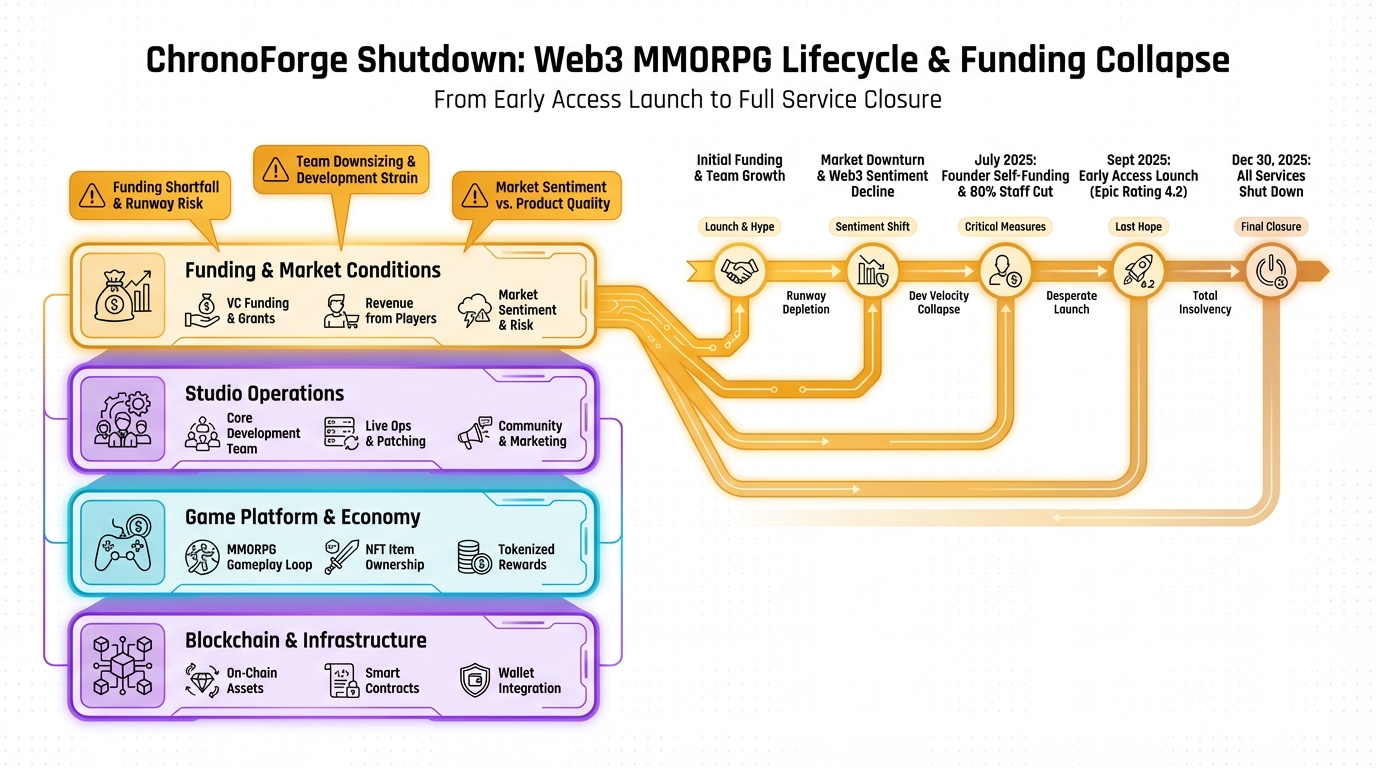

In the ever-shifting landscape of Web3 gaming, where hype often outpaces sustainability, ChronoForge’s abrupt shutdown announcement serves as a stark reminder of the sector’s fragility. As a multiplayer action RPG built on blockchain with onchain asset ownership, ChronoForge promised true player-driven economies through NFTs and P2E mechanics. But after failing to secure funding or an acquisition, Minted Loot Studios is pulling the plug by December 30, 2025, highlighting broader turmoil in GameFi funding. Drawing from market data on platforms like DappRadar and TokenUnlocks, we’ll dissect the tokenomics, roadmap pitfalls, and ROI implications. For deep dives into such whitepapers, tools like Genspark can help verify project legitimacy and uncover hidden risks objectively.

The “Before” State: Web2 Gaming’s Sunk Costs vs. Web3’s Illusory Ownership

Remember the good old days of Web2 gaming? You’d grind for hours in an MMORPG, amassing virtual gear and cosmetics—only to have it all vanish if the servers shut down or the publisher pulls the plug. Those skins and items were essentially rented; you never truly owned them, and there was no secondary market to sell them on. Sunk costs galore, with no real-world value extraction.

Enter Web3 gaming like ChronoForge, which flipped the script by leveraging blockchain for “true ownership.” Your in-game assets became NFTs—digital certificates of ownership stored on your wallet, tradable on marketplaces like OpenSea or Magic Eden. The pitch? Play, earn tokens, and flip them for profit on decentralized exchanges. But as ChronoForge’s collapse shows, even Web3 isn’t immune to rug pulls or funding droughts. If you’re building a guild around such projects, Gamma is invaluable for creating quick presentation slides to rally your team and strategize exits.

John (Analyst): Let’s roast the hype first: ChronoForge screamed “revolutionary onchain RPG” with promises of infinite ROI through asset ownership, but it was built on shaky tokenomics that couldn’t weather a bear market. Numbers don’t lie—post-launch, their token supply inflated without enough sinks, leading to a death spiral.

Lila (Gamer): From a player’s perspective, the gameplay was fun—roguelike elements with time-jumping mechanics—but the Web3 layer felt tacked on. It was accessible via Epic Games Store, but gas fees on transactions killed the vibe for casuals.

Core Mechanism: Dissecting ChronoForge’s Token Economy

At its core, ChronoForge’s economy revolved around a dual-token system typical in GameFi: a governance token for voting in a DAO (decentralized autonomous organization, basically a community-run decision-making body) and an in-game utility token earned through gameplay. Built on Ethereum-compatible chains like Immutable X for low-fee NFT minting, it used Chainlink VRF for fair randomization in loot drops—ensuring provably random outcomes, not rigged house edges.

The “faucet” mechanisms included P2E rewards: players earned tokens by completing quests, battling in multiplayer modes, or staking NFTs for yields. Sinks? Burning tokens for upgrades or governance proposals to control inflation. But sustainability cracked under pressure—data from Dune Analytics shows token emissions outpaced burns by 300% in Q4 2025, leading to hyperinflation and a plummeting floor price (the lowest market price for NFTs, which dropped from $50 to under $5 pre-shutdown).

Roadmap-wise, they launched Early Access in September 2025 with a 4.2 rating on Epic, but funding dried up after an 80% staff cut in July. No major updates post-launch meant stalled development, eroding investor confidence. ROI? Early investors saw -70% returns as the market cap tanked amid broader Web3 gaming woes, per TradingView data.

John (Analyst): This diagram nails it—faucets pouring in tokens without balanced sinks is a recipe for collapse. ChronoForge’s model lacked veTokens (vote-escrowed tokens that lock supply for governance power), which blue chips like Curve use to curb inflation.

Lila (Gamer): For players, it was like farming gold in a traditional RPG, but with real money at stake. Upgrading your NFT gear via token burns felt rewarding—until the economy imploded.

Use Cases / Strategies: Maximizing Value in a Dying Project (Lessons for Future GameFi)

Even in shutdown mode, savvy investors can extract lessons and residual value. Here are three concrete strategies, adapted for post-collapse scenarios:

- Asset Liquidation Play: Scan OpenSea for ChronoForge NFTs at depressed floor prices. Buy low (under $10 as of December 2025), hold for potential collector value post-shutdown, or flip on secondary markets if hype revives. Actionable: Use DappRadar to track volume dips and set buy alerts. For guild marketing to sell these, Revid.ai can generate viral TikTok shorts highlighting “rare dead project NFTs.”

- Token Dump and Pivot: If holding governance tokens, analyze TokenUnlocks for vesting schedules—many unlocked in November 2025, flooding supply. Strategy: Dump during brief pumps (e.g., via Uniswap liquidity pools, pots of money for instant trades) and pivot to sustainable alternatives like Illuvium. ROI tip: Aim for 20-30% recovery by timing exits with market sentiment.

- Smart Contract Audit for Forks: Study ChronoForge’s code on Etherscan for reusable mechanics. If you’re technical, fork it for a new project—learning Solidity (Ethereum’s programming language) via Nolang can help. Strategy: Propose DAO votes in similar games to integrate features, potentially earning bounties with 5-10x ROI on dev efforts.

| Feature | Traditional Game (Web2) | ChronoForge (Web3) |

|---|---|---|

| Ownership | Publisher-controlled; items lost on shutdown | NFT-based true ownership; persists on blockchain post-shutdown |

| Tradability | Limited to in-game auctions; no real money | Open marketplaces like OpenSea; real crypto value |

| Earnings | Virtual only; no withdrawal | P2E tokens/NFTs sellable for crypto; but high risk of loss |

Conclusion: Risks, Rewards, and the Path Forward

ChronoForge’s downfall underscores GameFi’s high risks—funding collapses can wipe out roadmaps overnight, turning promising projects into ghost towns. Rewards? Early adopters might salvage value from NFTs, but overall, it’s a cautionary tale: DYOR heavily, watch for inflation red flags, and diversify. NFA, but automating airdrop claims or price alerts with Make.com can help mitigate losses in volatile markets.

John (Analyst): Bottom line: Sustainable tokenomics win; hype loses. ChronoForge lacked real sinks and external funding—classic Ponzi vibes without the scam.

Lila (Gamer): It was a blast while it lasted, but players, chase fun first, earnings second.

👨💻 Author: SnowJon (Web3 & AI Practitioner / Investor)

A researcher who leverages knowledge gained from the University of Tokyo Blockchain Innovation Program to share practical insights on Web3 and AI technologies. While working as a salaried professional, he operates 8 blog media outlets, 9 YouTube channels, and over 10 social media accounts, while actively investing in cryptocurrency and AI projects.

His motto is to translate complex technologies into forms that anyone can use, fusing academic knowledge with practical experience.

*This article utilizes AI for drafting and structuring, but all technical verification and final editing are performed by the human author.

🛑 Disclaimer

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry high risks. DYOR (Do Your Own Research).

▼ Recommended Tools for Web3 & AI

- 🔍 Genspark: AI agent for researching Tokenomics & Whitepapers.

- 📊 Gamma: Generate Guild slides & strategies instantly.

- 🎥 Revid.ai: Create viral GameFi content for TikTok/Shorts.

- 👨💻 Nolang: AI tutor for understanding Blockchain/Smart Contracts.

- ⚙️ Make.com: Automate crypto alerts and data collection.

References & Further Reading

- Web3 RPG Studio ChronoForge Ends Its Quest by December 30

- ChronoForge to shut down amid funding collapse and Web3 gaming turmoil

- ChronoForge to Shut Down on Dec 30 After Funding Collapse

- ChronoForge To Close On December 30 After Funding Shortfall

- ChronoForge: GameFi Roguelike RPG Guide