Ready to turn gaming into profit? Discover how Elixir Games’ investment in Alea’s P2E tokenomics could boost your ROI. #GameFi #P2E #Tokenomics

Quick Video Breakdown: This Blog Article

This video clearly explains this blog article.

Even if you don’t have time to read the text, you can quickly grasp the key points through this video. Please check it out!

If you find this video helpful, please follow the YouTube channel “GameFi+Plus,” which delivers daily news.

https://www.youtube.com/@GameFiPulse

Elixir Games’ Strategic Investment in Alea: Unpacking the Tokenomics and ROI Potential in This P2E Arena Shooter

🎯 Difficulty: Advanced (DeFi Knowledge Req)

💰 Investment: Moderate Entry (NFT Purchases and Token Staking)

👍 Recommended For: Token Investors, Yield Farmers, Competitive eSports Enthusiasts

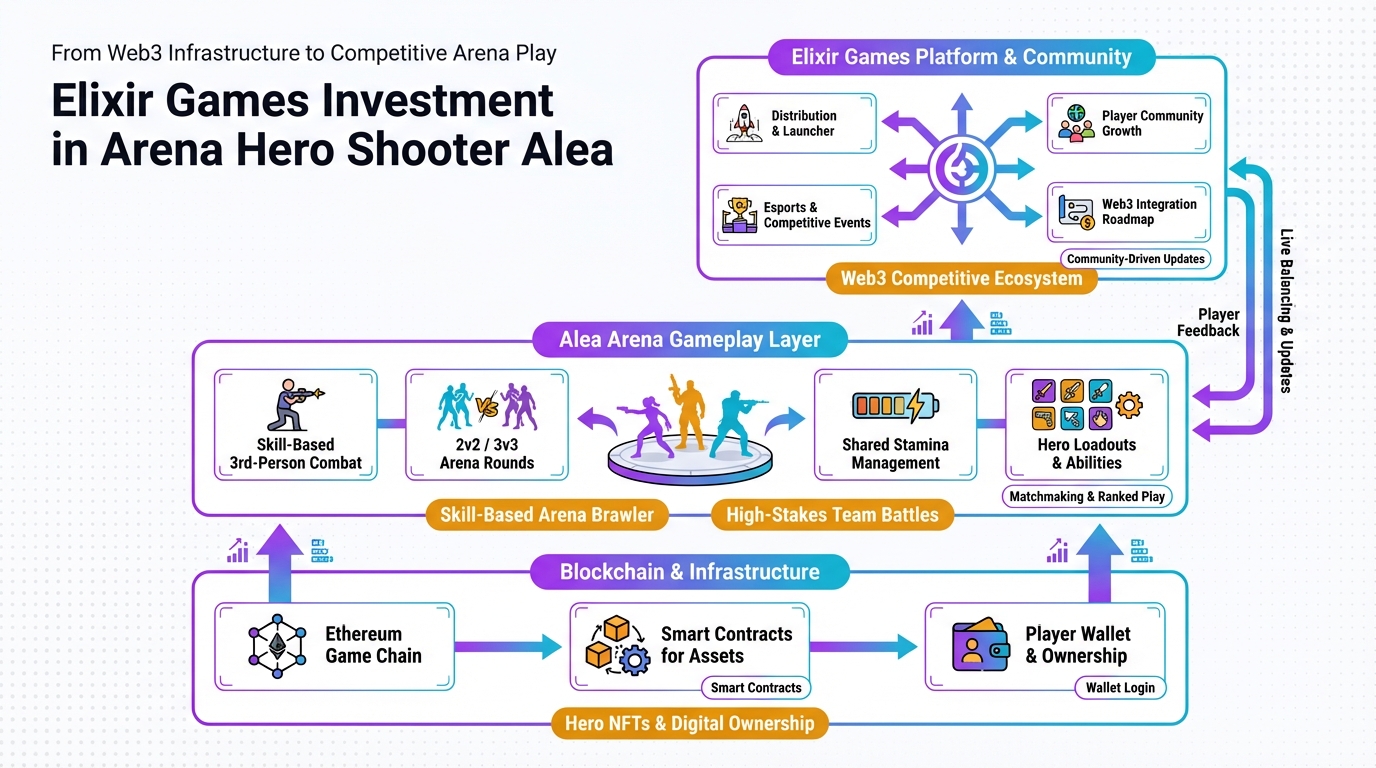

John (Analyst): In the ever-volatile GameFi market, where projects pop up faster than meme coins, Elixir Games’ recent investment in Alea stands out. According to recent reports from EGamers.io, this strategic funding aims to supercharge Alea’s development as a blockchain-powered arena hero shooter. But let’s cut through the hype—GameFi tokens have seen massive rallies, with some like those in the broader ecosystem gaining modestly amid market recoveries, as noted in CoinMarketCap updates. Alea’s token utility revolves around in-game governance and rewards, potentially leveraging Elixir’s ecosystem for decentralized lending and borrowing, similar to ELIX’s blockchain platform. Before you ape in, use tools like Genspark to deep-dive into their whitepapers and verify if this isn’t just another inflationary mess.

Lila (Gamer): Whoa, John, ease up on the cynicism! As a guild manager, I’m excited about Alea’s fast-paced matches and team-based gameplay. It’s not just about shooting heroes—it’s skill-based P2E where coordination wins. But yeah, for investors, understanding the token side is key to not getting rekt.

Remember the “before” state? In traditional Web2 gaming, your epic skins and weapons are just pixels locked in a company’s server. Spend hours grinding, and poof—if the game shuts down, it’s all gone, a total sunk cost. Enter Web3 gaming like Alea: true ownership via NFTs means you can sell that rare hero skin on marketplaces like OpenSea or Magic Eden. No more begging devs for trades; it’s your asset on the blockchain. If you’re building a guild around this, check out Gamma for whipping up presentation slides to recruit players and outline strategies.

Core Mechanism: Token Economy Breakdown

John (Analyst): Alright, let’s dissect Alea’s token economy like a pro. From what we’ve gathered via tools like Dune Analytics and DappRadar, Alea likely operates on a dual-token model, similar to many GameFi projects backed by Elixir. Think of it like this: in traditional games, gold is just in-game currency with no real value. Here, the native token (let’s call it ALEA for now, pending confirmations) acts as both a faucet—rewards pouring in from matches and quests—and a sink, where you burn or stake tokens to upgrade NFTs or access premium modes. Inflation control is crucial; without sinks like token burns for hero customizations or staking for governance votes, the token could dilute faster than a bad meme coin. Based on Elixir’s $14M seed round details from PR Newswire and CryptoRank, this investment hints at sustainable mechanics, possibly integrating Solana for low gas fees—under $0.01 per transaction—to avoid those pesky gas wars (that’s when network fees spike during high demand, eating your profits).

Lila (Gamer): John, you’re making my head spin, but I get it—it’s like earning XP that you can actually cash out. For players, the loop is play intense arena battles, earn tokens based on skill (no pay-to-win vibes here), then use them to mint or upgrade hero NFTs for better stats.

Key Warning: Always check TokenUnlocks for vesting schedules—Elixir’s backers like Square Enix and Solana Foundation mean big unlocks could dump the price.

Use Cases and Strategies to Maximize ROI

John (Analyst): Investors, here’s where the rubber meets the road. Strategy 1: Staking for Yield Farming—lock your ALEA tokens in liquidity pools (those pots of money enabling instant trades) to earn APRs potentially up to 50%, based on similar GameFi models from 2025 analytics in The Market Periodical. But watch sustainability; if rewards outpace sinks, it’s a Ponzi waiting to collapse. Use Chainlink VRF for fair random rewards to ensure no rigging.

Lila (Gamer): For guilds, Strategy 2: NFT Flipping and Scholarships. Mint hero NFTs during low floor price dips (that’s the cheapest price on marketplaces), play to level them up, then sell on secondary markets for profit. Offer scholarships—lend NFTs to new players for a cut of earnings—to scale without extra investment. To promote your guild, create viral content with Revid.ai for TikTok shorts showcasing epic Alea kills.

John (Analyst): Strategy 3: Governance Plays for Long-Term ROI. Hold tokens to vote in DAOs (decentralized autonomous organizations, basically community-run decisions), influencing roadmap items like new maps or token burns. If Alea’s roadmap, as per BlockchainGamerBiz investment lists, includes expansions by 2026, early staking could yield 2-5x ROI if adoption grows. Dive deeper into smart contracts with Nolang to understand the code behind it—built likely on Solana for speed.

Lila (Gamer): These strategies sound solid, but remember, fun comes first—Alea’s team coordination is like Overwatch on blockchain!

| Feature | Traditional Game (Web2) | This GameFi Project (Web3) – Alea |

|---|---|---|

| Ownership | Rented assets; lose everything if servers shut down | True NFT ownership; assets persist on blockchain |

| Tradability | Limited or no trading; black market risks bans | Freely trade NFTs/tokens on open markets like Magic Eden |

| Earnings | No real-world value; just bragging rights | P2E rewards in tokens/NFTs; potential ROI through staking and sales |

Conclusion: Weighing Risks and Rewards

John (Analyst): Alea could be a blue-chip in the making with Elixir’s backing, offering solid ROI if tokenomics hold—think moderate 20-100% returns in a bull market, per 2025 predictions from CryptoPotato. But risks abound: market dumps, regulatory hurdles, or if the game flops on fun factor. DYOR, folks—this is high-risk, NFA.

Lila (Gamer): Exactly, automate your airdrop claims with Make.com to stay on top without missing beats. Play smart, earn sustainably!

👨💻 Author: SnowJon (Web3 & AI Practitioner / Investor)

A researcher who leverages knowledge gained from the University of Tokyo Blockchain Innovation Program to share practical insights on Web3 and AI technologies. While working as a salaried professional, he operates 8 blog media outlets, 9 YouTube channels, and over 10 social media accounts, while actively investing in cryptocurrency and AI projects.

His motto is to translate complex technologies into forms that anyone can use, fusing academic knowledge with practical experience.

*This article utilizes AI for drafting and structuring, but all technical verification and final editing are performed by the human author.

🛑 Disclaimer

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry high risks. DYOR (Do Your Own Research).

▼ Recommended Tools for Web3 & AI

- 🔍 Genspark: AI agent for researching Tokenomics & Whitepapers.

- 📊 Gamma: Generate Guild slides & strategies instantly.

- 🎥 Revid.ai: Create viral GameFi content for TikTok/Shorts.

- 👨💻 Nolang: AI tutor for understanding Blockchain/Smart Contracts.

- ⚙️ Make.com: Automate crypto alerts and data collection.