Read this article in your native language (10+ supported) 👉

[Read in your language]

Moku’s $50K Guild Grants: Analyzing the Economic Push for Grand Arena Season 1 in GameFi

🎮 Gameplay Type: Strategy, AI-Driven Fantasy Sports with NFT Integration

👍 Recommended For: Guild Leaders Seeking Community Expansion, Tokenomics Analysts Evaluating Sustainability, Web3 Investors Monitoring Incentive Structures

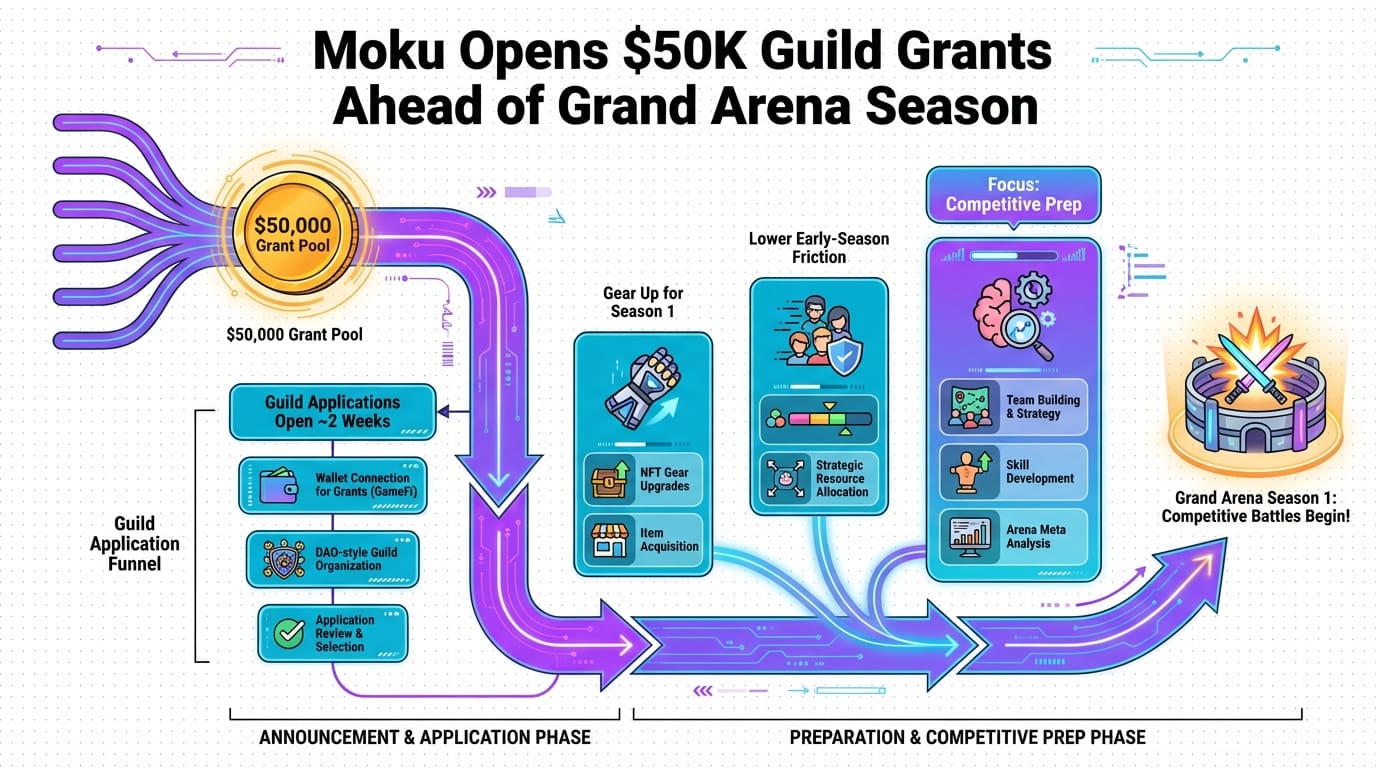

John (Analyst): In the ever-evolving GameFi landscape, where projects often promise the moon but deliver dust, Moku’s announcement of $50,000 in guild grants ahead of Grand Arena Season 1 caught my eye—not for the hype, but for what it reveals about their structural approach. Built on the Ronin Network, this initiative isn’t just throwing money at guilds; it’s a calculated move to bootstrap community engagement in an AI-powered fantasy sports ecosystem. Why does this matter? Because in GameFi, sustainability hinges on balancing incentives with long-term economic design, and grants like these can either fuel organic growth or mask underlying token inflation issues. Let’s dissect this without the fluff.

Lila (Gamer): Hey, John, you’re always so skeptical! But from a player’s side, this grant program feels like a smart way to empower guilds—those organized groups of players who team up for shared strategies and rewards. It’s tied to Grand Arena, where AI athletes (called Mokis) compete 24/7 in fantasy battles. If you’re into building communities, this could make onboarding new players way more exciting.

Before diving into Moku’s model, let’s contrast it with traditional Web2 games. In a classic fantasy sports app like ESPN Fantasy or Yahoo Sports, you might spend hours drafting teams and competing, but your “assets” are just digital points trapped on the platform. If the servers shut down or the company pivots, poof—your time investment vanishes with no recourse. No true ownership, no secondary markets for trading lineups, and certainly no way to earn real value from your strategies. GameFi projects like Moku flip this script by leveraging NFTs for verifiable ownership—your Moki athletes and cards are yours on the blockchain, tradable on marketplaces like those on Ronin. This introduces economic layers, but it also brings risks like market volatility and potential rug pulls if the tokenomics aren’t sound.

Core Mechanism: Token Economy and Incentive Design

John (Analyst): Alright, let’s get to the meat: Moku’s tokenomics. From what I’ve pieced together via on-chain data and official docs on Ronin, the ecosystem revolves around token emissions tied to gameplay and grants. The $50K guild grants are distributed in tokens or stable assets to qualifying guilds, aiming to boost participation in Grand Arena Season 1, which features a $1M prize pool. This is essentially an emission mechanism—new tokens or rewards entering circulation to incentivize activity. But here’s the roast: if you’ve seen projects like Axie Infinity, you know unchecked emissions can lead to hyper-inflation, crashing token value. Moku counters this with token sinks, like entry fees for contests or upgrades for NFT Mokis, which remove tokens from supply. Sustainability? It’s promising on paper, but watch the unlock schedules—large tranches of tokens vesting to early holders could flood the market. Long-term risks include over-reliance on prize pools; if user growth stalls, the economy could deflate like a popped balloon.

Lila (Gamer): John, you’re harsh, but fair. For players, the loop is: collect NFT cards via booster boxes (sold on Ronin), build lineups of AI Mokis, enter daily fantasy contests, and earn rewards based on performance. It’s like real fantasy sports but nonstop, with prediction markets adding a betting twist—though remember, if this veers into gambling mechanics, it might be regulated or illegal in places like Japan; this is just info, not advice.

Key Risk Note: GameFi is high-risk; token values can plummet due to market conditions or poor design. Always verify contract addresses on explorers like Roninscan before engaging, and start small to test the waters.

Use Cases / Play Styles

John (Analyst): Participation in Moku isn’t one-size-fits-all. Here are three realistic styles, grounded in economic realities—remember, outcomes depend on market dynamics, not guarantees.

1. Guild Operator Scaling: As a guild leader, apply for the $50K grants to fund recruitment and tools. Use the boost to organize members for coordinated entries in Grand Arena contests, sharing rewards via DAO-like structures (that’s a decentralized autonomous organization—basically a community-voted treasury). This could enhance retention but requires managing token flows to avoid internal inflation.

2. Token Holder Monitoring: If you’re an analyst, stake or hold Moku tokens while tracking metrics like daily active users and token burn rates via dashboards like Dune Analytics. Participate minimally in gameplay to test sinks, evaluating if the $1M prize pool drives sustainable liquidity without diluting value.

3. Hybrid Investor-Gamer: Buy NFT booster boxes during sales (like the October 2025 event), trade rares on secondary markets, and enter low-stakes contests. This blends play with speculation, but watch for volatility—NFT floor prices can crash if hype fades.

Lila (Gamer): Totally! These styles make it accessible for different commitment levels, but yeah, no promises on profits—it’s all about the strategy and community vibes.

Comparison: Traditional Web2 Game vs. Moku GameFi Project

| Aspect | Traditional Web2 Game (e.g., ESPN Fantasy) | Moku GameFi Project |

|---|---|---|

| Ownership | No true ownership; assets are platform-locked and non-transferable. | NFT-based ownership of Mokis and cards, tradable on Ronin marketplaces. |

| Progression | Seasonal resets with no lasting value; progression is for bragging rights only. | Persistent upgrades via tokens and NFTs, with potential real-world value through secondary sales. |

| Economy Design | Centralized, ad-driven revenue; no player economy. | Decentralized with token sinks, emissions, and grants; risks of inflation if not balanced. |

Conclusion

John (Analyst): Moku’s guild grants highlight a thoughtful incentive layer, potentially fostering sustainable growth in Grand Arena’s AI fantasy ecosystem. Strengths include strong token sinks via gameplay and a focus on community, but risks like emission overload and market dependency loom large. Evaluate based on on-chain metrics—it’s worth watching for signals of longevity.

Lila (Gamer): Agreed, the learning value is in mastering AI strategies while understanding Web3 economics. But remember, success depends on your engagement and broader market conditions—play smart!

👨💻 Author: SnowJon (Web3 & AI Practitioner / Researcher)

A researcher leveraging insights from the University of Tokyo Blockchain Innovation Program to analyze GameFi, Web3, and digital economies from a practical and structural perspective.

His focus is on translating complex systems into frameworks that readers can evaluate and think about critically.

*AI may assist with drafting, but final verification and responsibility rest with the human author.

References & Further Reading

- Moku Opens $50K Guild Grants Ahead of Grand Arena Season 1

- Ronin Network Launches Moku Guild Boost Program for Grand Arena Season 1

- Moku Announces Grand Arena Season One with $1M Prize Pool

- Apply to the Moku Guild Boost Program now!