Personally, Heroes of Mavia feels tactical. The new guild mode adds meaningful depth.#GameFi #Web3Gaming

Quick Video Breakdown: This Blog Article

This video clearly explains this blog article.

Even if you don’t have time to read the text, you can quickly grasp the key points through this video. Please check it out!

If you find this video helpful, please follow the YouTube channel “GameFi+Plus,” which delivers daily news.

https://www.youtube.com/@GameFiPulse

Read this article in your native language (10+ supported) 👉

[Read in your language]

Heroes of Mavia’s Alliance Wars: Analyzing the 2026 Competitive Mode’s Impact on GameFi Sustainability

🎮 Gameplay Type: Strategy (Base-Building & Multiplayer Battles)

👍 Recommended For: Tokenomics Enthusiasts, Competitive Guild Leaders, Long-Term Web3 Investors

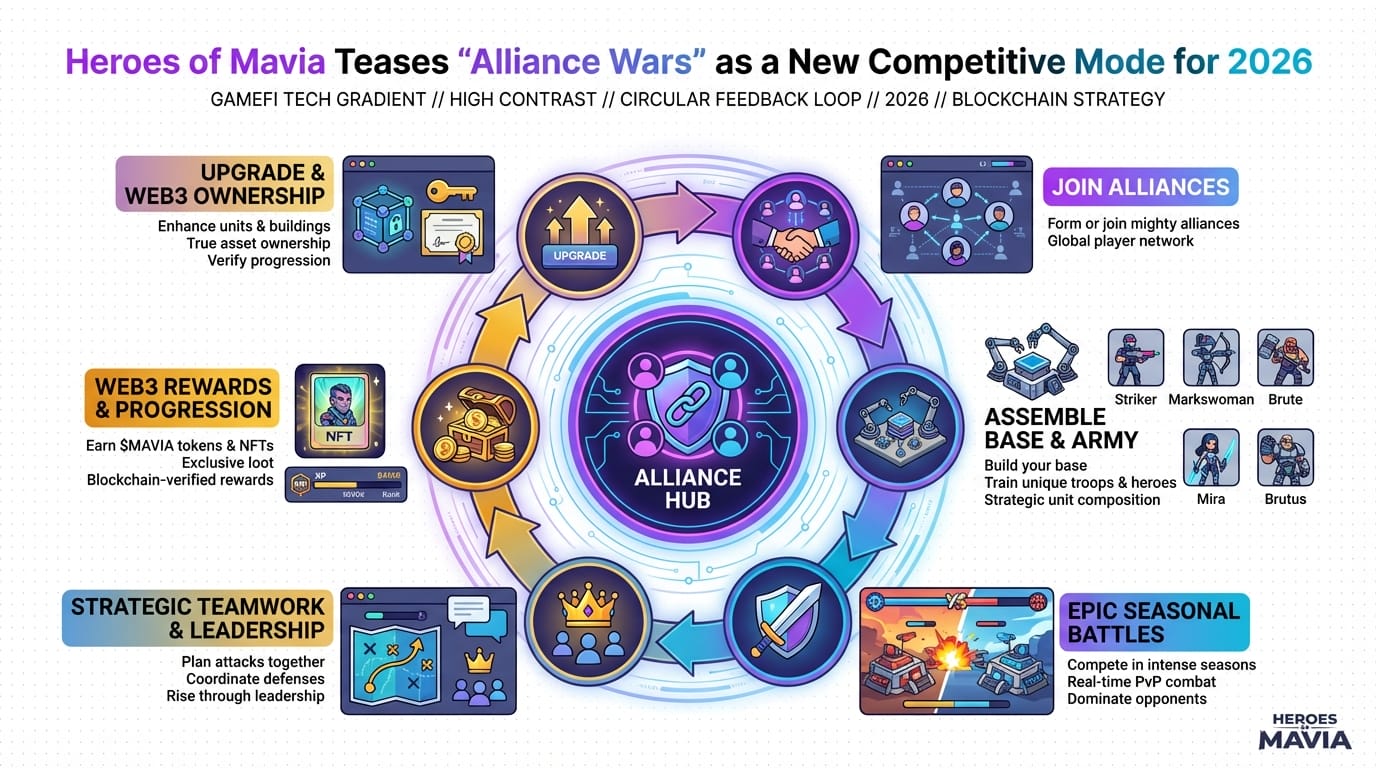

Lila (Gamer): Hey everyone, if you’re into strategy games with a blockchain twist, Heroes of Mavia has been teasing something big for 2026: Alliance Wars. This new competitive mode sounds like it’ll ramp up guild-based battles, but let’s not get ahead of ourselves. John, as our resident cynic, what’s the market context here? Why does this matter beyond the hype?

John (Analyst): Lila, you’re right to temper the excitement. Heroes of Mavia isn’t just another mobile strategy game; it’s a GameFi project built on Ethereum with integrations like Immutable X for low-cost transactions. Launched in 2024, it drew comparisons to Clash of Clans but with NFTs for bases and troops, plus the MAVIA token for governance and rewards. The 2026 Alliance Wars mode, as teased in recent updates, aims to introduce large-scale, guild-versus-guild warfare, potentially tying into seasonal events and token burns. But structurally, this matters because GameFi is maturing—projects like this are shifting from pure play-to-earn (P2E) hype to sustainable ecosystems. With Bitcoin stabilizing in the high $80,000s and altcoins like MAVIA seeing speculative pumps (up 375% in March 2025 per Mitrade reports), we need to evaluate if Alliance Wars addresses core issues like token inflation or just adds more volatility.

The “Before” State: Web2 Games vs. GameFi Evolution

John (Analyst): Before diving into Mavia’s specifics, let’s contrast traditional Web2 games with GameFi. In a Web2 title like Clash of Clans, you grind for resources, build your base, and battle—but everything’s locked in the developer’s servers. If the game shuts down, your time and money vanish; it’s a sunk cost with no real ownership. Skins or items? They’re non-transferable, and progression is gated by paywalls without secondary markets.

Lila (Gamer): Exactly, John. In GameFi like Heroes of Mavia, blockchain changes that. Your base is an NFT you truly own in your wallet, tradeable on marketplaces. Earnings come from gameplay, but with risks—market crashes can wipe out value. It’s empowering, but volatile.

John (Analyst): Spot on. This ownership model, powered by Ethereum smart contracts, creates real economies. But without proper design, it’s just a dressed-up Ponzi—early players cash out, leaving latecomers holding depreciating tokens.

Core Mechanism: Tokenomics and Economic Design

John (Analyst): At its core, Heroes of Mavia’s economy revolves around the MAVIA token, with a total supply of 250 million as per its 2022 tokenomics assessment. Think of it like gold in a traditional game: you earn it through battles, use it to upgrade, or stake it for governance votes. Emission comes from gameplay rewards and airdrops, but sinks—mechanisms that remove tokens from circulation—are crucial for sustainability. These include transaction fees, item upgrades, and now, potentially, Alliance Wars entry fees or prize pools that burn MAVIA.

Lila (Gamer): From a player’s view, the loop is build base → train troops → battle for resources → earn MAVIA or Ruby (in-game currency) → upgrade and repeat. Alliance Wars could add guild alliances, where teams coordinate massive attacks, earning shared rewards. But John, how does this avoid the inflation pitfalls we saw in early P2E games?

John (Analyst): Good question. Tokenomics here emphasize deflationary mechanics: 40% of supply is for ecosystem rewards, but with vesting schedules to prevent dumps. The 2025 roadmap, as detailed in Pool Party Nodes, includes Ruby 2.0 migration for better token flow. Sustainability hinges on balancing emission (new tokens minted) against sinks (tokens burned or locked). Long-term risks? High inflation if player growth stalls—MAVIA’s price predictions for 2025-2030 range from $5 to $50 (per CoinDCX), but that’s speculative. Alliance Wars might introduce competitive staking, where guilds lock tokens for buffs, acting as a sink. However, if it’s just reward farming without real utility, it could accelerate sell pressure. On-chain data from explorers like Etherscan would show actual burn rates—worth checking for red flags like whale dumps.

Lila (Gamer): And don’t forget accessibility. The game uses Immutable X for zero-gas NFT minting, making it beginner-friendly despite the complexity.

Use Cases / Play Styles: Realistic Participation Approaches

Lila (Gamer): Let’s talk real ways to engage without promising moonshots. First, the casual strategist: Log in daily for quick raids, earn small MAVIA rewards, and sell NFTs on secondary markets if values rise. It’s low-commitment, fitting for mobile players.

John (Analyst): Second, the guild operator: Form or join an alliance, coordinate for Alliance Wars events. Stake MAVIA for guild perks, but monitor token unlocks—outcomes depend on team skill and market sentiment, not guarantees.

Lila (Gamer): Third, the long-term holder: Focus on building a high-value NFT base, participate in governance votes via staked MAVIA, and treat it like a digital asset portfolio. Alliance Wars could boost visibility, potentially increasing asset demand, but volatility is key—evaluate based on community activity.

John (Analyst): Remember, all styles carry risks; GameFi is high-volatility, and external factors like Ethereum gas fees can impact play.

| Feature | Traditional Web2 Game (e.g., Clash of Clans) | Heroes of Mavia (GameFi) |

|---|---|---|

| Ownership | No true ownership; items tied to account and servers | NFT-based; assets in your wallet, tradeable anytime |

| Progression | Grind or pay for speed-ups; no real-world value | Earn tokens/NFTs with market value; progression tied to economy |

| Economy Design | Centralized, developer-controlled inflation | Decentralized with token sinks; risks of hyperinflation if unbalanced |

Conclusion: Strengths, Risks, and Critical Evaluation

John (Analyst): Heroes of Mavia’s Alliance Wars could be a design strength, fostering community-driven economies and token utility through competitive modes. Learning value lies in understanding sustainable GameFi—strong sinks like burns can counter inflation, as seen in its fixed supply model. However, structural risks include dependency on player retention; if hype fades post-2026 launch, MAVIA could face sell-offs. Outcomes depend entirely on player behavior, market conditions, and updates—always verify on-chain metrics.

Lila (Gamer): It’s fun with strategy depth, but start small and focus on enjoyment over earnings. GameFi is high-risk; no guarantees here.

👨💻 Author: SnowJon (GameFi / Web3 Researcher)

A researcher leveraging insights from the University of Tokyo Blockchain Innovation Program to analyze GameFi economies and Web3 adoption from a practical, evidence-first perspective.

The focus is translating complicated systems into frameworks readers can evaluate critically—fun factor, token sinks, inflation risk, and sustainability signals.

*AI may assist drafting, but final verification and responsibility rest with the human author.

References & Further Reading

- Heroes of Mavia Teases “Alliance Wars” as a New Competitive Mode for 2026

- Heroes of Mavia Price Prediction 2025–2030

- Heroes of Mavia: 2025 Roadmap and Latest Game Updates

- Mavia Tokenomics Assessed

- Heroes of Mavia (MAVIA) Rallies After Adding Gaming Features