The Sandbox’s 2025 review is out. Is its tokenomics model truly sustainable? Dive deep into the GameFi economy and risks.#TheSandbox #GameFi #Tokenomics

Quick Video Breakdown: This Blog Article

This video clearly explains this blog article.

Even if you don’t have time to read the text, you can quickly grasp the key points through this video. Please check it out!

If you find this video helpful, please follow the YouTube channel “GameFi+Plus,” which delivers daily news.

https://www.youtube.com/@GameFiPulse

Read this article in your native language (10+ supported) 👉

[Read in your language]

Dissecting The Sandbox’s 2025 Year-in-Review: Tokenomics, Sustainability, and Game Economy Insights

🎮 Gameplay Type: Metaverse Builder / User-Generated Content

👍 Recommended For: Blockchain analysts seeking economic models, researchers studying NFT integration, advanced users evaluating long-term Web3 investments

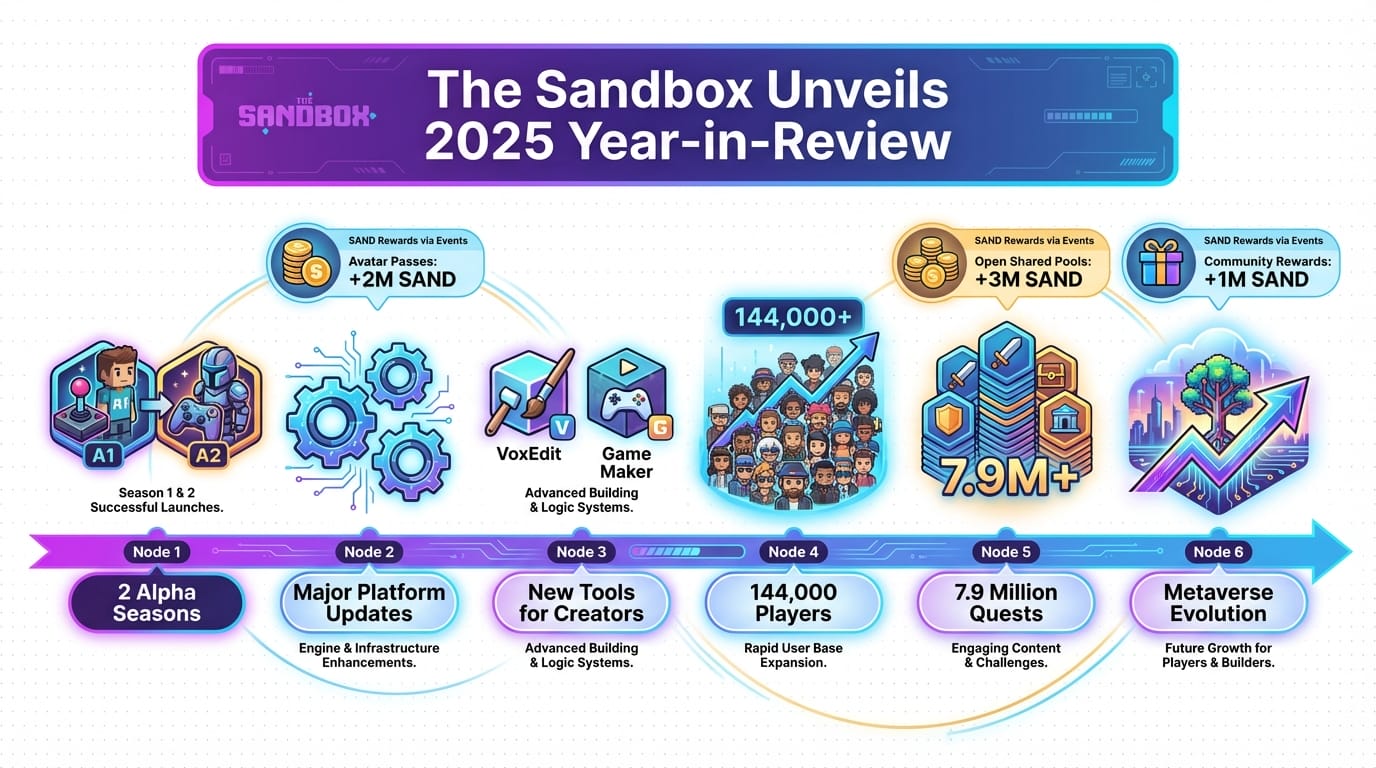

John (Analyst): In the evolving landscape of GameFi, The Sandbox stands out as a metaverse platform that’s been pushing boundaries since its inception. The recent 2025 year-in-review, as detailed in sources like PlayToEarn, highlights a year of significant updates, including two Alpha Seasons and tools for creators, with over 144,000 players and 7.9 million quests completed. But as a veteran tokenomics analyst, I’m here to cut through the surface-level achievements and examine what this means structurally for the project’s economy. Why does it matter? Because in a market flooded with volatile tokens, The Sandbox’s SAND-driven ecosystem offers a case study in balancing user-generated content with sustainable token flows—though not without risks.

Lila (Gamer): Hey, John, while you’re crunching numbers, let’s not forget the player side. The Sandbox isn’t just about tokens; it’s a creative playground where you build worlds, own land as NFTs, and interact in a decentralized metaverse. The 2025 review shows real evolution, like enhanced creator tools that make building more accessible. But yeah, sustainability is key—I’ve seen too many games hype up earnings only to crash.

John (Analyst): Exactly. Before diving into The Sandbox’s specifics, consider the “before” state: traditional Web2 games like Fortnite or Roblox trap value in centralized servers. You spend time and money on skins or items, but if the company shuts down or changes policies, it’s all gone—pure sunk cost with no real ownership. GameFi flips this: through NFTs on blockchain (in The Sandbox’s case, built on Ethereum with Polygon for scalability), players get true ownership. Sell your virtual land or assets on secondary markets like OpenSea, potentially recouping value. However, this introduces economic volatility; Web2 offers stability at the cost of control, while GameFi’s open markets can lead to boom-bust cycles if not designed well.

Core Mechanism: Tokenomics and Economy Design

John (Analyst): At its core, The Sandbox’s economy revolves around the SAND token, an ERC-20 utility token used for transactions, governance, and staking. Emission mechanics are tied to gameplay and land sales—think of it like gold in a traditional MMO, but with real-world value. Tokens are minted through activities like quest completions (over 7.9 million in 2025, per the review), but to prevent inflation, there are sinks: fees for land purchases, asset creation, and even burning mechanisms in some updates. The 2025 year-in-review notes major platform upgrades, which likely include refined token flows to support creator economies. However, sustainability hinges on balancing supply: too much emission from player rewards could flood the market, driving down SAND’s value, as we’ve seen in past GameFi projects audited via tools like Dune Analytics.

Lila (Gamer): From a player’s view, it’s like earning XP that you can trade. You buy or earn LAND NFTs, build experiences, and attract visitors who pay in SAND. The Alpha Seasons in 2025 brought seasonal events, boosting engagement without over-relying on hype.

John (Analyst): Logic-driven analysis shows strengths in decentralization—The Sandbox uses Chainlink for verifiable randomness in some mechanics, ensuring fair drops. But long-term risks include token sink inadequacy: if burns and fees don’t match emissions, we get dilution. Data from sources like Newzoo’s 2025 gaming report indicates broader industry shifts toward sustainable models, yet The Sandbox must watch external factors like Ethereum gas fees impacting accessibility.

Use Cases / Play Styles

Lila (Gamer): Let’s talk realistic ways to engage. First, as a creator: Buy LAND, use the VoxEdit tool to design assets, and monetize via visitor fees or NFT sales. It’s hands-on, but outcomes depend on your creativity and market demand—I’ve built mini-games that drew crowds during Alpha Seasons.

John (Analyst): Second, as an investor-researcher: Analyze tokenomics by staking SAND for rewards or participating in governance via the DAO (decentralized autonomous organization—community voting on proposals). This style suits those monitoring on-chain data, like SAND’s circulating supply via Etherscan, to assess value retention.

Lila (Gamer): Third, as a casual explorer: Join quests or events without heavy investment, earning small SAND amounts. The 2025 review’s 144,000 players show broad appeal, but remember, participation doesn’t guarantee profits—it’s about enjoyment and community.

John (Analyst): In all cases, evaluate based on market conditions; hype from reports like the Blockchain Game Alliance’s 2025 insights can inflate engagement temporarily.

Comparison: Traditional Web2 Game vs. The Sandbox

| Feature | Traditional Web2 Game (e.g., Roblox) | The Sandbox (GameFi Project) | Ownership | Platform-controlled; items can be revoked or lost on shutdown | True NFT ownership; transferable via blockchain wallets | Progression | Grind for in-game rewards with no external value | Earn SAND tokens with potential real-world trade value, tied to quests and builds | Economy Design | Centralized, with microtransactions benefiting the company | Decentralized with token sinks, emissions, and community governance, but subject to market volatility |

|---|

John (Analyst): This table underscores The Sandbox’s edge in ownership, but Web2’s stability avoids crypto‘s risks like hacks or bear markets.

Conclusion: Weighing Strengths and Risks

John (Analyst): The Sandbox’s 2025 year-in-review reveals a robust ecosystem with strong creator tools and engagement metrics, teaching valuable lessons in decentralized economies. Design strengths include effective token sinks via fees and burns, fostering sustainability. However, structural risks like inflation from over-emission or external market downturns (as noted in CoinMarketCap’s recent GameFi updates) could undermine value. Outcomes depend entirely on player behavior, adoption rates, and broader crypto conditions—always verify on-chain data and start small.

Lila (Gamer): It’s a fun metaverse with real potential, but play smart—focus on the experience, not just earnings.

Disclaimer: GameFi is high-risk; this is not financial advice. Understand the volatility and legal aspects in your region.

👨💻 Author: SnowJon (Web3 & AI Practitioner / Researcher)

A researcher leveraging insights from the University of Tokyo Blockchain Innovation Program to analyze GameFi, Web3, and digital economies from a practical and structural perspective.

His focus is on translating complex systems into frameworks that readers can evaluate and think about critically.

*AI may assist with drafting, but final verification and responsibility rest with the human author.

References & Further Reading

- The Sandbox Unveils 2025 Year-in-Review | PlayToEarn

- Year in review: 2025 to date | Newzoo

- Key Takeaways: Blockchain Game Alliance 2025 State of the Industry Report | BitPinas

- GameFi News: More Crypto Market Pain, Beware of Web3 Gaming Malware | CoinMarketCap

- The Sandbox Price Prediction: Will SAND Coin Reach $10? | Stealthex